$1,000 Average Tax Refund: The topic $1,000 average tax refund for 2026 is shaping up to be one of the biggest financial stories of the year, and for good reason. Millions of Americans are entering tax season expecting a noticeably bigger refund check—something that could influence budgets, savings plans, and spending habits nationwide. With tax changes kicking in after recent federal reforms, the average taxpayer could see up to $1,000 more in their refund compared to previous years. For families living paycheck to paycheck, young adults just getting started, and even seasoned professionals managing complex finances, this bump isn’t just loose change—it’s a meaningful financial shift. Understanding why, how, and what to do about it can help Americans get the fullest benefit possible from tax season 2026.

Table of Contents

$1,000 Average Tax Refund

The 2026 tax season is shaping up to be one of the most impactful in recent memory, with the average tax refund increasing by around $1,000 for millions of Americans. Powered by tax reforms, expanded credits, and updated withholding tables, these changes bring meaningful benefits nationwide—especially for families, lower-income workers, and anyone claiming key refundable credits. With smart preparation, early filing, and careful review of available credits, taxpayers can make the most of these new opportunities and secure the highest refund possible.

| Key Point | Details |

|---|---|

| Average Refund Increase | Tax refunds are projected to increase by up to $1,000 for the 2026 season. |

| Reason for Increase | Changes in federal tax law, expanded credits, and updated withholding tables. |

| Who Benefits Most | Families with children, low-to-moderate-income workers, and taxpayers claiming refundable credits. |

| IRS Filing Deadline | April 15, 2026 (unless extended). |

| Tax Reforms Impacting Refunds | Expanded Child Tax Credit, higher standard deductions, and Earned Income Tax Credit adjustments. |

| Official Reference | Visit the official Internal Revenue Service website: https://www.irs.gov |

Why Refunds Are Increasing: Understanding the Big Picture

Tax refunds don’t magically get bigger—there’s always a story behind the numbers. The 2026 refund boost stems from federal tax changes, updated deduction limits, and shifts in how much tax employers withhold throughout the year.

1. Expanded Child Tax Credit (CTC)

The Child Tax Credit, already a popular tax benefit, has been expanded once again. While final numbers may vary by income bracket and dependents:

- The credit amount for each eligible child is higher.

- More families qualify under the expanded income thresholds.

- The refundable portion increased, meaning even families who owe little or no tax still get extra cash back.

This change alone could add several hundred dollars to a refund.

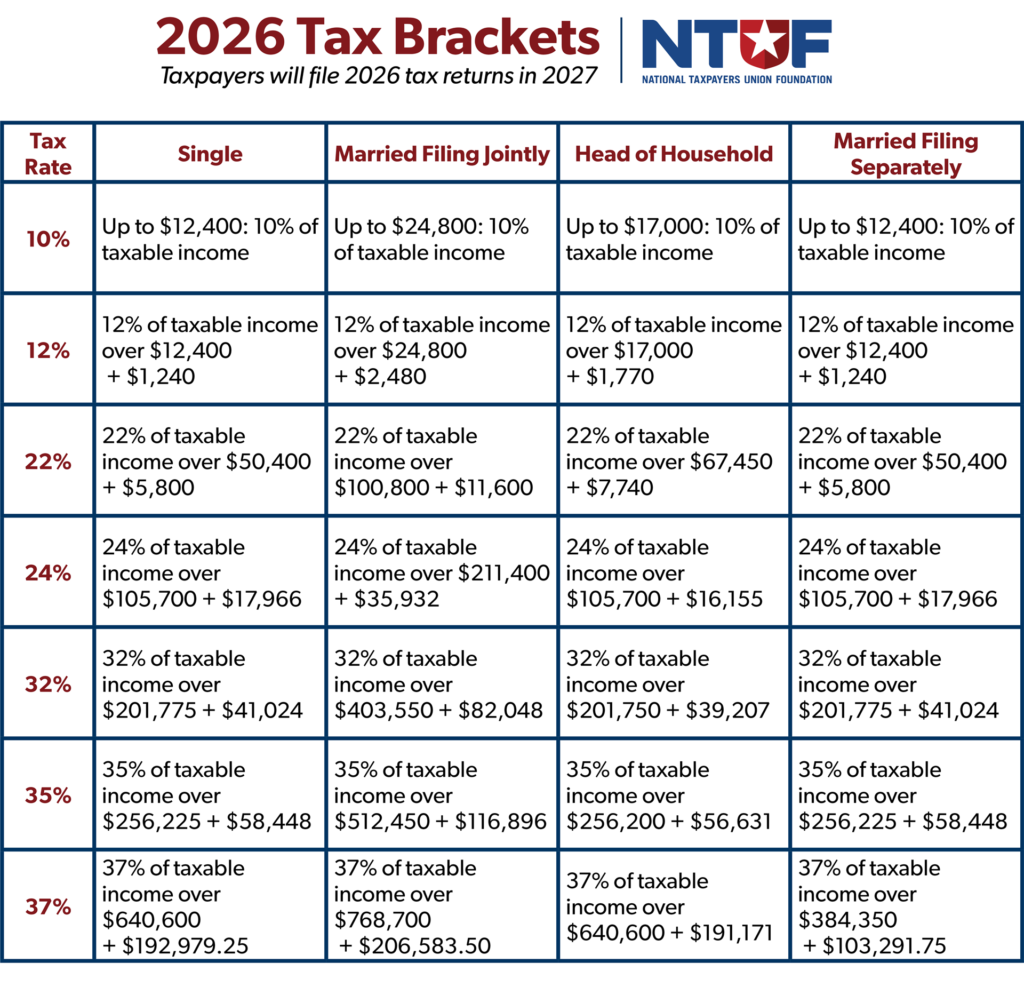

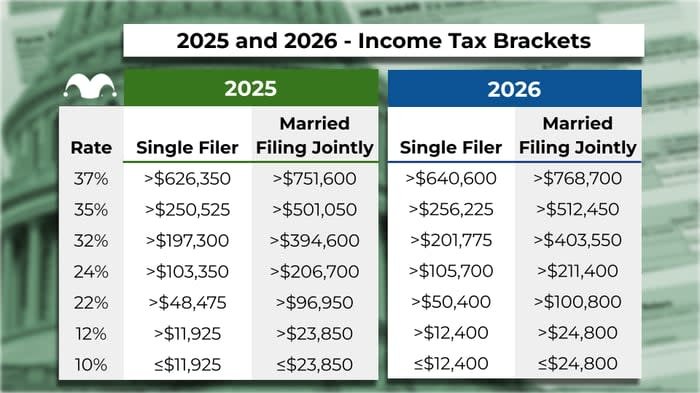

2. Higher Standard Deduction

The standard deduction increases nearly every year due to inflation adjustments, but 2026 brings a larger-than-usual bump, partially tied to legislative changes.

This is great news because:

- Most Americans take the standard deduction rather than itemizing.

- A higher deduction means less taxable income.

- Less taxable income usually means a higher refund, or at least less tax owed.

3. Adjusted Withholding Tables

Many employers will not fully update withholding rates until late in the year, meaning workers may have had more money withheld than necessary in 2025. That extra withholding translates into bigger refunds in early 2026.

This doesn’t mean people earn less—it just means the IRS is giving back the difference in one lump sum.

4. Earned Income Tax Credit (EITC) Updates

Low- to moderate-income workers benefit most from the EITC, and recent adjustments:

- Increase the credit amount,

- Expand income eligibility,

- Improve refund outcomes for both individuals and families.

This credit alone could raise refunds by hundreds to over a thousand dollars, depending on circumstances.

How Much Money Will You Actually Get Back?

While the talk around an “average $1,000 increase” is grabbing headlines, refunds always depend on personal tax situations. Let’s break down what different taxpayers might expect.

Scenario A: Single Worker With No Children

- Earns $35,000/year.

- Typically receives a modest refund.

- Could see a $300–$600 boost due to withholding changes and the standard deduction increase.

Scenario B: Single Parent With Two Children

- Earns $45,000/year.

- Receives both CTC and EITC.

- Could see $1,000–$1,500 more this year due to expanded credits.

Scenario C: Married Couple With Three Children

- Household income: $95,000.

- Benefits from higher credit amounts and deduction increases.

- Possible refund boost: $800–$1,200 depending on eligibility.

Scenario D: Retired Taxpayer

- Receives Social Security and small pension.

- Low taxable income after deductions.

- May see smaller impacts, but still possibly $200–$400 in added refund, depending on additional withholding adjustments.

These examples illustrate a simple truth: most Americans will benefit, but the size of the refund depends on income, dependents, and credit eligibility.

How to Maximize Your Average Tax Refund?

Even though refunds are already projected to be bigger this year, smart planning can help you keep even more money in your pocket.

1. Double-Check Your Filing Status

Many taxpayers accidentally choose the wrong status. For example, Head of Household offers higher deductions and often larger refunds—but only if you qualify. Single parents especially should verify their eligibility.

2. Claim Every Credit You Qualify For

The biggest refund boosters include:

- Child Tax Credit (CTC)

- Earned Income Tax Credit (EITC)

- American Opportunity Tax Credit (AOTC)

- Saver’s Credit

- Premium Tax Credit (PTC)

These credits can stack up, creating refund increases in the hundreds or thousands.

3. Review Your Withholding

If you consistently receive huge refunds, you may want to adjust your W-4 form to match your tax liability. This prevents the IRS from holding too much of your money during the year.

4. Keep Records Organized

Professionals and first-time filers alike benefit from organized documentation:

- W-2 forms

- 1099s

- Receipts for deductions

- Mortgage or student loan interest statements

This reduces mistakes and speed up returns.

5. File Early

Filing early means:

- Faster refunds

- Reduced risk of identity theft

- More time to fix mistakes if they arise

And with tens of millions filing every season, the early bird truly does get the worm here.

6. Use Reliable Tax Software or a Professional

Tax laws change often, and the 2026 season includes several notable updates. Filing software or professionals stay current with these changes, reducing the risk of missed opportunities.

Why This $1,000 Average Tax Refund Matters for Americans?

A $1,000 swing in average refunds is no small matter. For families living on tight budgets, this refund season is almost like receiving a bonus or unexpected raise.

Here’s why this matters:

1. Increased Household Spending Power

Many Americans use refunds to:

- Catch up on bills

- Pay off debt

- Buy essentials

- Start emergency funds

With rising living costs, this bump can stabilize household finances.

2. Boost to the U.S. Economy

Refund season often fuels:

- Retail spending

- Home improvement purchases

- Travel

- Auto repairs

- Medical expenses

Thousands of businesses indirectly benefit from higher refunds.

3. Improved Financial Security

Financial advisors often say that even a few hundred dollars can help someone build a safety net. A $1,000 bump can be life-changing for:

- Young families

- Lower-income workers

- Retirees

This refund season offers a unique opportunity to start building long-term financial habits.

February 2026 Stimulus and IRS Payments — What’s Real and What’s Not

New IRS Rule Targets PayPal, Venmo, and Cash App Tax Reporting in 2026

IRS Confirms $1776 Tax-Free Payments for 1.5 million Americans