$6,000 Senior Tax Exemption: The newly introduced $6,000 senior tax exemption is shaking up conversations about tax policy, retirement, and fairness across generations. Launched as part of a sweeping new federal tax initiative, the policy aims to lighten the load for older Americans—but many critics argue it’s leaving younger generations behind. While the intentions are noble, the backlash is real, and the exemption has stirred a much broader conversation about who benefits from U.S. tax policies and who’s still waiting their turn. Let’s break it all down—what it is, who it helps, who’s raising eyebrows, and what it means for you or your family.

Table of Contents

$6,000 Senior Tax Exemption

The $6,000 senior tax exemption is a big deal for retirees—and a big flashpoint in the national conversation about fairness and equity in America’s tax system. While seniors gain much-needed relief, younger Americans are asking when their turn will come. Tax policy can be a tricky beast. But one thing’s for sure—we need to keep talking about how to build a system that helps everyone, not just one age group.

| Feature | Details |

|---|---|

| Policy Name | $6,000 Senior Tax Deduction under the Working Families Tax Cut |

| Eligible Group | Taxpayers aged 65 and above |

| Effective Period | 2025 to 2028 (temporary) |

| Income Limits | Singles up to $75,000, Married up to $150,000 for full benefit |

| Phase-Out Threshold | Expires at $175,000 for singles, $250,000 for couples |

| Type | Deduction (reduces taxable income) |

| Estimated Impact | Saves seniors $500–$1,200 annually |

| Cost to U.S. Budget | Estimated $93 billion over four years |

| Official Info | IRS.gov |

What Is the $6,000 Senior Tax Exemption?

The $6,000 senior tax exemption is a federal income tax deduction for Americans aged 65 or older. It’s not a refund or direct payment—rather, it reduces the amount of income the IRS considers taxable, which in turn lowers your total tax bill.

It comes from the newly passed One Big Beautiful Bill Act (OBBBA), part of a broader effort to adjust the tax code in response to inflation and rising living costs, especially for retirees on fixed incomes.

The deduction applies in addition to existing deductions, such as the senior standard deduction. It’s essentially an extra cushion meant to keep more money in seniors’ pockets.

Who Qualifies for $6,000 Senior Tax Exemption?

To claim the exemption, you must meet these criteria:

- Age 65 or older by December 31 of the tax year (starting 2025).

- Income under:

- $75,000 for single filers

- $150,000 for married couples filing jointly

- Above those limits, the deduction gradually phases out and disappears completely at:

- $175,000 for singles

- $250,000 for married couples

You don’t need to be retired. You can still be working full-time or part-time and qualify as long as you meet the age and income thresholds.

How It Works: A Quick Example

Let’s say Barbara, a 67-year-old widow, earns $50,000 annually from a small pension and part-time job. Her standard deduction for seniors in 2025 is $15,700 (projected). With the new $6,000 deduction, her taxable income drops to $28,300—potentially saving her an extra $720 to $950, depending on her tax bracket.

For married couples, the benefit can double—up to $12,000 in total deductions if both spouses are eligible.

What Makes This Deduction Different?

This is not the first time seniors have received tax perks. In fact, the IRS has long allowed additional standard deductions for those 65 and up.

But this new policy:

- Applies on top of existing deductions

- Has a specific phase-out structure

- Is temporary, valid for 2025 to 2028

This structured approach targets middle- and lower-income seniors while excluding high earners, a move aimed at fairness and fiscal responsibility.

Why Seniors Say It’s Needed?

Supporters argue that seniors face unique challenges, especially in today’s economy. They note that:

- Most retirees live on fixed incomes from Social Security or pensions.

- Medical expenses rise dramatically with age.

- Many older adults are helping raise grandchildren or support adult children.

- Inflation has eroded the value of Social Security payments.

The Senior Citizens League estimates that Social Security has lost over 30% of its buying power since 2000. Housing, food, and healthcare costs have skyrocketed, often leaving seniors struggling to stay afloat.

Generational Fairness: Why the Backlash?

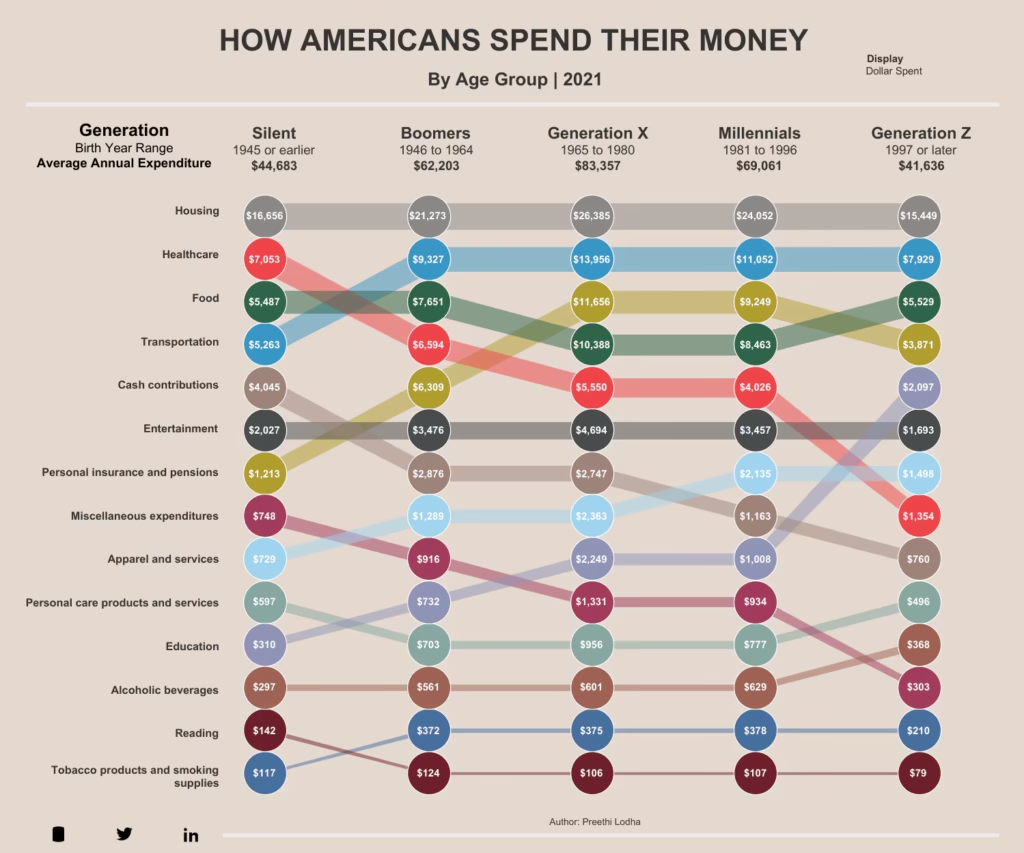

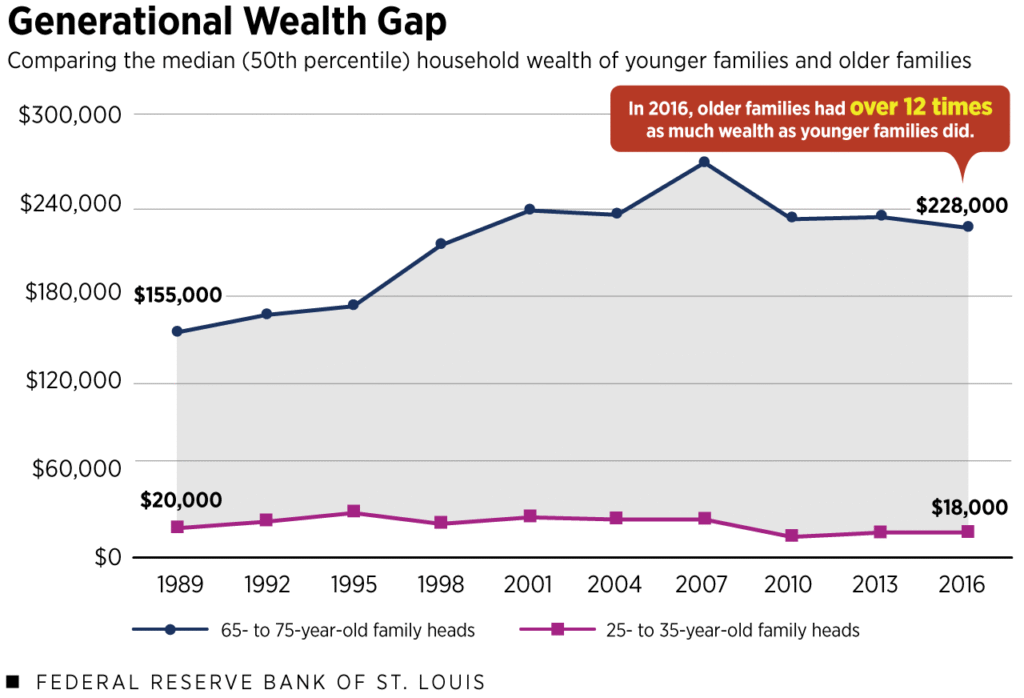

While many hail the policy as a win for retirees, critics argue it exposes deep cracks in generational equity.

Younger Americans—especially Millennials and Gen Z—are expressing frustration that:

- They get little to no targeted tax relief, despite rising costs.

- Many pay high student loans, childcare, and rent or mortgages.

- They don’t benefit from property tax breaks, inheritance, or low-cost healthcare like previous generations did.

Economists also point out that Baby Boomers control over 70% of the nation’s wealth, yet continue to receive more public benefits compared to younger working Americans.

It’s not about being anti-senior—it’s about asking: Are we balancing the books fairly across generations?

How the U.S. Compares Globally?

In global terms, the U.S. offers more senior-specific tax breaks than many developed countries.

- In Canada, there’s a smaller pension income credit, but no senior-specific deduction.

- Germany taxes pensions more heavily and offers fewer deductions.

- Sweden uses public subsidies for seniors instead of tax cuts.

So, in context, the U.S. is among the most generous to its elderly in terms of tax policy—especially when combined with programs like Social Security and Medicare.

Voices from Both Sides

Gloria Thomas, 70, retired teacher:

“Every dollar counts when you’re on a fixed income. This helps me pay for prescriptions without skipping groceries.”

Dante Rivera, 32, delivery driver and single dad:

“We need childcare deductions, housing credits, something—anything. My rent is half my paycheck, and there’s no help for people like me.”

These personal stories underscore the emotional divide behind this policy—where relief for one group can feel like neglect for another.

Expert Insights

Dr. Eric Noll, Economist at Brookings:

“This exemption is targeted and well-intentioned. But it must be part of a broader reform that doesn’t leave out working families.”

Tasha Bell, Certified Tax Advisor:

“It’s a good time for seniors to re-evaluate their tax strategy, especially if they’re considering retirement in the next few years.”

The takeaway? This is a piece of the puzzle, not the whole solution.

What About Younger Taxpayers?

If you’re under 65 and wondering, What’s in this for me?—you’re not alone. Unfortunately, the current legislation offers little relief for:

- Renters

- Parents of young children

- Student loan borrowers

- Gig economy workers

Policy advocates are pushing for reforms to the Child Tax Credit, affordable housing incentives, and student debt forgiveness to bring balance.

How to Claim the $6,000 Senior Tax Exemption (Step-by-Step)?

- Confirm Your Age – Must be 65 or older by December 31.

- Check Your Income – Use your MAGI (Modified Adjusted Gross Income).

- File Your Taxes – Use IRS Form 1040 for federal filing.

- Claim Standard Deduction – This deduction adds to your standard deduction.

- Document Everything – Keep SSA records, retirement income forms, and ID.

- Get Professional Help – A tax pro can help ensure you maximize the benefit.

Budget & Policy Impact

According to estimates, the exemption will cost the U.S. government about $93 billion over four years. Some lawmakers have warned that if extended or expanded, the cost could balloon beyond $150 billion by 2032.

As with any tax cut, the money has to come from somewhere—or it could add to the national deficit.

Critics worry that temporary relief for one group may lead to long-term burdens on future taxpayers.