The Internal Revenue Service (IRS) has clarified how a long-standing federal tax credit works after online claims suggested taxpayers could reduce their Tax Bill by Up to Half through a newly confirmed online process. While the claim contains a kernel of truth, the agency and tax experts say the credit involved — the Saver’s Credit — is neither new nor automatic, and it applies only under specific conditions tied to retirement savings.

The clarification comes as millions of Americans prepare for the 2026 filing season, following a surge in social media posts and blog articles that implied the IRS had introduced a simple digital step capable of dramatically reducing federal tax obligations. According to the IRS, no such standalone program exists, and taxpayers should approach such claims cautiously.

Table of Contents

IRS Confirms an Online Step That Could Reduce Your Tax Bill by Up to Half

| Key Fact | Detail |

|---|---|

| Credit Name | Saver’s Credit (Retirement Savings Contributions Credit) |

| Maximum Credit Rate | 50% of eligible contributions |

| Contribution Cap | $2,000 per person; $4,000 joint |

| Maximum Credit Value | $1,000 individual; $2,000 joint |

| Refund Type | Non-refundable |

| Claim Method | IRS Form 8880 with federal return |

What the IRS Has Actually Confirmed

The IRS has confirmed that it continues to administer the Saver’s Credit under existing law. Contrary to viral claims, the agency has not launched a new online application or portal that automatically reduces a Tax Bill by Up to Half for eligible filers.

Instead, the credit must be claimed as part of the standard tax filing process, either electronically or on paper. IRS officials note that misleading headlines often arise from confusion over how tax credits function, particularly the difference between refundable and non-refundable credits.

In public guidance, the IRS emphasizes that taxpayers should rely on official IRS publications or licensed tax professionals when evaluating tax-saving opportunities.

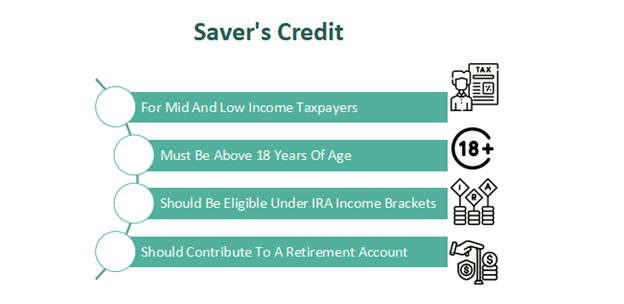

Understanding the Saver’s Credit

What Is the Saver’s Credit?

The Saver’s Credit, formally known as the Retirement Savings Contributions Credit, was created to encourage low- and moderate-income workers to save for retirement. It allows eligible taxpayers to claim a credit for contributions made to qualified retirement accounts, including:

- Traditional and Roth Individual Retirement Accounts (IRAs)

- 401(k), 403(b), and 457 plans

- SIMPLE IRAs and SEP IRAs

The credit directly reduces federal income tax owed, which is why it is often described as a way to reduce a Tax Bill by Up to Half — though that phrasing can be misleading without context.

How the Credit Rate Is Determined

The amount of the Saver’s Credit depends on a taxpayer’s adjusted gross income (AGI) and filing status. The IRS applies a tiered structure:

- 50% credit for taxpayers in the lowest income brackets

- 20% credit for middle-income eligible filers

- 10% credit for higher eligible incomes

- 0% credit once income exceeds statutory limits

The maximum percentage — 50% — applies only to a portion of retirement contributions and only to taxpayers who meet strict income requirements.

How Much Can the Credit Actually Reduce Taxes?

While headlines often highlight the phrase Tax Bill by Up to Half, the actual dollar impact is capped. The credit applies to:

- Up to $2,000 in contributions for individuals

- Up to $4,000 for married couples filing jointly

At the 50% rate, the maximum credit equals $1,000 per person or $2,000 per couple.

This means the credit can significantly reduce tax liability for eligible filers but cannot eliminate large tax bills entirely unless the filer’s total tax owed is already relatively small.

Non-Refundable vs. Refundable Credits

A critical source of confusion lies in the Saver’s Credit being non-refundable.

A non-refundable credit:

- Can reduce tax owed to zero

- Cannot generate a refund beyond taxes already paid

In contrast, refundable credits — such as the Earned Income Tax Credit — can result in refunds even when no tax is owed.

Tax analysts say misunderstanding this distinction fuels exaggerated claims that the IRS is offering refunds equivalent to half of all taxes paid.

Why Misleading Claims Continue to Circulate

Tax experts note that algorithm-driven content platforms often reward sensational phrasing. Terms like “confirmed,” “online step,” and “Tax Bill by Up to Half” attract attention but may oversimplify or distort the underlying policy.

Many such articles fail to clearly explain income limits, contribution caps, or the non-refundable nature of the credit. Others omit that the Saver’s Credit has existed for years, leading readers to believe it represents a new benefit.

How to Claim the Saver’s Credit Correctly

Taxpayers who believe they may qualify should follow these steps:

- Contribute to an eligible retirement account during the tax year

- File a federal tax return using Form 1040

- Complete IRS Form 8880, which calculates the credit

- Retain documentation of contributions

Most modern tax preparation software automatically evaluates eligibility and applies the credit when Form 8880 is completed.

Who Typically Benefits the Most?

According to tax policy experts, the Saver’s Credit primarily benefits:

- Younger workers starting retirement savings

- Part-time or hourly workers

- Households with modest earnings but steady employment

However, participation rates have historically been low. Studies by policy groups suggest many eligible taxpayers are unaware the credit exists or mistakenly believe they do not qualify.

Policy Context: Why the Credit Exists

The Saver’s Credit reflects a broader federal effort to strengthen retirement preparedness among Americans who lack access to employer pensions. Lawmakers from both parties have cited declining personal savings rates and increasing retirement insecurity as long-term economic risks.

Recent legislative proposals have aimed to expand or simplify the credit, though no major structural changes have taken effect for the upcoming filing season.

Expert Perspective

Tax professionals stress that while the Saver’s Credit can meaningfully reduce a Tax Bill by Up to Half for some filers, it works best as part of a broader financial strategy.

“Tax credits tied to retirement savings reward long-term planning,” one certified public accountant noted. “But they require awareness and proactive contributions — they are not windfalls.”

What This Means for the 2026 Filing Season

As filing season approaches, the IRS urges taxpayers to verify claims through official channels and avoid relying on viral tax advice. The agency continues to emphasize electronic filing, free filing options for eligible households, and the importance of accurate reporting.

There are no indications the IRS plans to introduce a new automatic system that independently reduces a Tax Bill by Up to Half outside the existing credit structure.

Bottom Line

Despite widespread online claims, the IRS has not unveiled a new digital program that automatically reduces a Tax Bill by Up to Half. What exists is the long-standing Saver’s Credit, a targeted incentive designed to encourage retirement savings among lower- and moderate-income workers. When claimed correctly, it can substantially reduce federal tax liability — but only within clearly defined limits.

As tax season approaches, experts advise taxpayers to focus on verified IRS guidance and long-term financial planning rather than viral shortcuts promising dramatic savings.

FAQs About IRS Confirms an Online Step That Could Reduce Your Tax Bill by Up to Half

Can everyone reduce their tax bill by up to half?

No. Only taxpayers who meet income limits and contribute to qualifying retirement accounts may receive the maximum Saver’s Credit rate.

Is the Saver’s Credit new?

No. It has been part of the tax code for years, though awareness remains limited.

Does this credit increase my refund?

Only indirectly. It reduces tax owed but does not generate refunds beyond taxes already paid.

Do Roth IRA contributions qualify?

Yes, both Roth and traditional IRA contributions may qualify.

Is there an online IRS application for this credit?

No. The credit is claimed through normal tax filing using Form 8880.