2.8% COLA Adjustment: If you’re approaching retirement, already collecting Social Security, or planning for your future, you’ve probably heard this already — Social Security checks are going up in 2026. The 2.8% COLA (Cost-of-Living Adjustment) is now official, and it’s going to affect over 71 million Americans, including retirees, disabled workers, and SSI recipients. But what does that really mean for your wallet? How does this small-sounding number turn into real dollars, and how do Medicare costs, inflation, and earnings rules play into the picture? Let’s break it all down, from the ground up — with stats, context, examples, and insights that are easy to follow whether you’re 10 or 70.

Table of Contents

2.8% COLA Adjustment

The 2.8% COLA adjustment in 2026 is more than just a percentage point — it’s a reflection of economic shifts, inflation realities, and the government’s promise to help retirees keep up with the cost of living. While the raise may feel modest compared to rising healthcare costs, it still provides a valuable boost to millions living on fixed incomes. By understanding how COLA works — and how it interacts with Medicare, taxes, and wages — you can better prepare, plan, and stretch each Social Security dollar further.

| Topic | 2026 Update |

|---|---|

| COLA Increase | 2.8% increase in Social Security & SSI benefits starting Jan 2026 |

| Who Benefits | ~71–75 million recipients, including retirees, disabled workers, and survivors |

| Average Monthly Increase | ~$56/month more for average retiree |

| First Increased Payments | SSI: Dec 31, 2025Social Security: Jan 2026 |

| Max Monthly Benefit (Retired at 70) | $5,251/month |

| Earnings Limit for Workers Under FRA | $24,480/year |

| Maximum Taxable Wage Base (FICA) | $184,500 |

| Official SSA Info | ssa.gov/cola |

What Is the 2.8% COLA Adjustment and Why Does It Matter?

Each year, the Social Security Administration (SSA) adjusts benefits to account for inflation — this is called a Cost-of-Living Adjustment, or COLA. It’s like a raise, but one that’s designed to help you keep up with real-world price hikes.

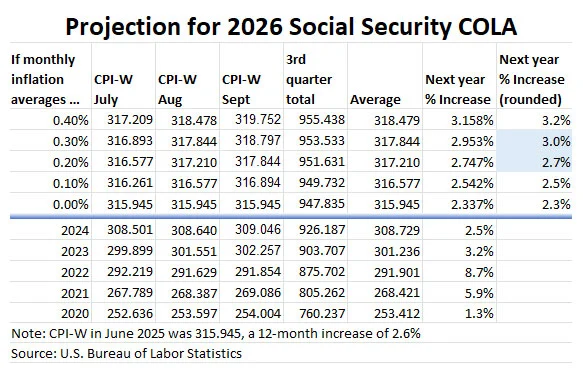

How is COLA calculated? It’s based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI‑W). When inflation rises — say gas prices go up, groceries get more expensive — the CPI‑W tracks those changes. SSA then compares the average CPI-W from the third quarter of one year to the next.

If prices increase, so do Social Security payments. For 2026, prices rose enough to justify a 2.8% increase, which is slightly higher than 2025’s 2.5% bump.

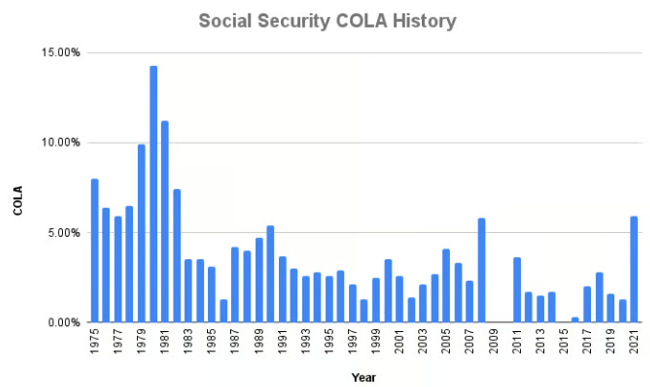

Historical Context: How Does 2.8% Compare?

For perspective, here’s how recent COLAs stack up:

| Year | COLA % |

|---|---|

| 2023 | 8.7% |

| 2024 | 3.2% |

| 2025 | 2.5% |

| 2026 | 2.8% |

The spike in 2023 was due to post-pandemic inflation. While 2.8% seems modest, it’s actually above average over the past decade. It reflects cooling inflation and a stabilizing economy — but for those living on fixed income, even a few dollars can be a big deal.

What the Average Person Will Receive?

Let’s break down real examples:

- Average retired worker (2025): $2,015/month

- With 2.8% COLA: ~$2,071/month

- Annual increase: ~$672/year

For a couple receiving combined benefits, this could mean an extra $1,200–$1,300 a year, depending on their current payments.

Supplemental Security Income (SSI) recipients will also see increases:

- Individual SSI max (2025): ~$966

- 2026 max with COLA: ~$994

- Couple max (2026): ~$1,491

Not life-changing money — but a significant help with rising food and utility bills.

When Will You See the 2.8% COLA Adjustment Raise?

- SSI recipients will see the bump starting December 31, 2025.

- Social Security beneficiaries get their first increased payment in January 2026.

The payment date depends on your birthdate:

- Born 1st–10th: Paid 2nd Wednesday

- Born 11th–20th: Paid 3rd Wednesday

- Born 21st–31st: Paid 4th Wednesday

Medicare Premiums: The Catch That Shrinks Your Raise

Here’s where things get tricky. Medicare Part B premiums (the ones most folks have deducted from their Social Security check) are rising too.

- 2026 Part B premium: Estimated around $202.90/month

- 2026 Part B deductible: ~$283/year

This means that while your gross check goes up, your net deposit might only increase by $30–$40/month, depending on your plan.

Some years, premium hikes eat up most or all of COLA. The “hold harmless” provision ensures your check can’t decrease from one year to the next — but it doesn’t guarantee a big bump.

Working While Collecting Benefits: What to Know

Planning to work while collecting Social Security before full retirement age (FRA)? Pay attention to this:

- 2026 earnings limit: $24,480

- Earn more than that? SSA withholds $1 for every $2 over the limit.

Example:

If you earn $28,000, you’re $3,520 over. SSA would withhold $1,760 from your benefits.

Good news: Once you reach your FRA (typically 66–67), SSA recalculates your benefit and pays back what they withheld — so it’s not lost forever.

High Earners Pay More Social Security Taxes

Each year, SSA sets a taxable earnings cap — the amount of your income subject to Social Security tax (6.2% for employees).

- 2026 cap: $184,500

- Any income over that is not taxed for Social Security, though it’s still subject to Medicare taxes.

For the highest earners, this means more taxes paid in, but also potentially larger benefits later — especially if they delay filing until age 70.

How the 2.8% COLA Adjustment Impacts Retirement Planning?

COLA adjustments matter even before you claim benefits. Here’s why:

- Delayed Retirement Means Bigger Checks:

If you wait until age 70, your benefit increases each year — on top of COLA. - Budgeting Becomes Predictable:

Knowing COLA helps you forecast future income. While you can’t predict exact rates, a 2–3% annual increase is a safe planning assumption. - Healthcare Inflation Outpaces COLA:

Since medical inflation often exceeds CPI-W, some advisors suggest putting part of each COLA toward a “healthcare buffer fund.” - Taxes on Benefits May Rise:

While COLA increases income, income tax thresholds for Social Security have been frozen since 1984. That means more people could see a portion of their benefits taxed unless Congress adjusts those brackets.

Tips to Make the Most of Your COLA Increase

- Track your new payment: Log in to your mySocialSecurity account.

- Reassess your budget: Consider allocating part of the raise to cover rising utility or grocery costs.

- Monitor Medicare options: Shop around for Medicare Advantage or Part D plans each open enrollment to save.

- Talk to a tax professional: Especially if you’re close to income limits that affect taxation on benefits.

- Avoid over-withholding: If you’re still working, review your tax withholding to avoid surprises.

Social and Economic Impact of the 2.8% COLA Adjustment

A COLA boost does more than help individual retirees — it injects billions into the U.S. economy. According to the National Committee to Preserve Social Security & Medicare:

“Every dollar paid in Social Security benefits results in about $2 of economic activity.”

That means 2026’s increase could generate over $80 billion in consumer spending — mostly in local grocery stores, pharmacies, and utility payments.

It also helps reduce poverty among seniors. Without Social Security:

- 40% of older Americans would fall below the poverty line.

- With benefits, that number drops to 10%.

So yes — even a 2.8% bump matters deeply to millions.

Why Some IRS Refunds May Be Delayed Until March for Credit Claimants – Check Details

$6,000 Senior Tax Exemption Sparks Debate Over Generational Fairness

IRS Confirms an Online Step That Could Reduce Your Tax Bill by Up to Half