Turning Point for Retirement in the U.S.: Why 2026 is shaping up to be a turning point for retirement in the U.S. isn’t just a headline — it’s the wake-up call every American should hear, from Wall Street pros to folks flipping pancakes at the local diner. Whether you’re just starting to stash cash in your 401(k) or already dreaming about RV trips and grandkid spoiling, 2026 is going to change how we retire in America — maybe forever. Between new federal laws, financial uncertainty, rising healthcare costs, and demographic shifts, 2026 has all the makings of a “before and after” moment in the retirement story. So grab your coffee — let’s break this down into plain English.

Table of Contents

Turning Point for Retirement in the U.S.

2026 is shaping up to be a defining moment for retirement in the U.S. — not because of one law or one budget, but because multiple forces are colliding: legal, economic, demographic, and personal. Whether you’re years away from retiring or already collecting Social Security, now’s the time to get smart, get prepared, and get proactive. The good news? You don’t have to do it alone. Financial advisors, online tools, and new employer benefits are all here to help you ride the wave. If you take the time to act now — save smart, plan wisely, and stay informed — you’ll be ready for whatever 2026 brings.

| Topic | Details |

|---|---|

| Target Year | 2026 marks a major shift in U.S. retirement rules and trends |

| SECURE 2.0 Act | Mandates auto-enrollment in new retirement plans, Roth catch-up contributions for high earners |

| Medicare Outlook | Hospital Insurance Trust projected to be insolvent by 2026 without reform |

| Social Security | Still solvent until 2034, but will require benefit cuts if Congress doesn’t act |

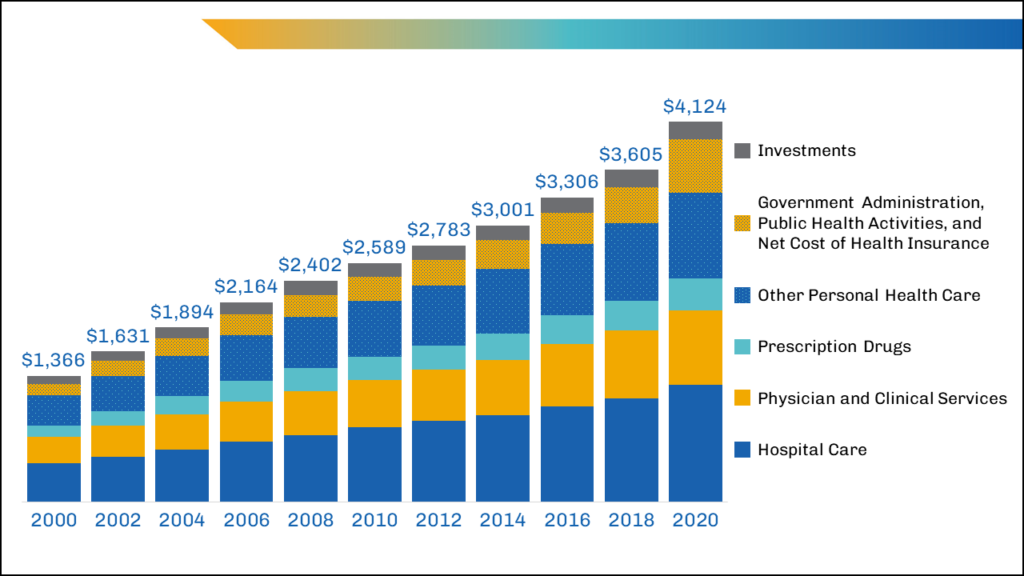

| Healthcare Inflation | Healthcare spending forecast to grow 5.4% annually by 2026 |

| Retirement Delays | Labor force participation rising among Americans 65+ due to cost pressures |

| Financial Planning Shift | Rise in annuities, Roth accounts, emergency savings funds in retirement plans |

| Trustworthy Resource | AARP’s 2026 Retirement Outlook |

The Big Picture: Why 2026 Is the Turning Point for Retirement in the U.S.

America’s aging population is colliding with a retirement system that’s been under stress for years. As of 2024, over 10,000 baby boomers turn 65 each day — a trend that continues into 2030. By that year, about 20% of the U.S. population will be over age 65, according to the U.S. Census Bureau.

That massive demographic shift has led to serious questions:

- Can Social Security keep up?

- Will Medicare still cover hospital care without going bankrupt?

- Are 401(k)s and IRAs enough to sustain retirement for 20–30 years?

2026 is when many of those questions come to a head.

The SECURE 2.0 Act: Retirement, Rewritten

The SECURE 2.0 Act (Setting Every Community Up for Retirement Enhancement) was passed in December 2022. While some rules have already gone into effect, 2026 is the year the biggest provisions drop. Here’s what that means for you:

1. Mandatory Auto-Enrollment in 401(k)s

Starting in 2026, employers launching new retirement plans must automatically enroll employees, beginning with a 3% contribution, increasing 1% annually up to 10%.

- Why this matters: Many employees — especially younger or lower-income ones — don’t sign up for retirement plans. Auto-enroll solves that.

- Example: If you earn $50,000, 3% auto-enrollment puts $1,500/year toward retirement — without you lifting a finger.

Vanguard research shows participation rates jump from 47% to over 90% with auto-enrollment. That’s real impact.

2. Roth Catch-Up Contributions Required for High Earners

If you’re 60 to 63 and earn more than $145,000, any extra “catch-up” contributions to your 401(k) must go into a Roth account starting in 2026.

- Translation: You’ll pay taxes now, but enjoy tax-free withdrawals in retirement.

- 2026 Limit: Catch-up contributions jump to $10,000 or 150% of the standard catch-up — whichever is greater.

This benefits people who expect higher taxes later or want tax-diversified retirement buckets.

3. Emergency Savings Tied to Retirement

A brand-new option lets employers offer emergency savings accounts linked to your 401(k), up to $2,500.

- Why this helps: Many Americans withdraw early from 401(k)s during emergencies — triggering penalties.

- In 2026: You’ll have penalty-free access to up to $1,000/year from your retirement plan for emergencies.

The Medicare Time Bomb

Another reason 2026 matters? Medicare’s financial lifeline is thinning fast.

According to the 2023 Medicare Trustees Report, the Hospital Insurance Trust Fund (which covers inpatient care) will be depleted by 2026 if Congress doesn’t act. That doesn’t mean Medicare stops paying, but it does mean the system can only cover 91% of costs going forward.

What to Expect:

- Higher premiums for Parts B and D

- Reduced hospital coverage unless reforms are passed

- More pressure to buy Medigap or Advantage plans

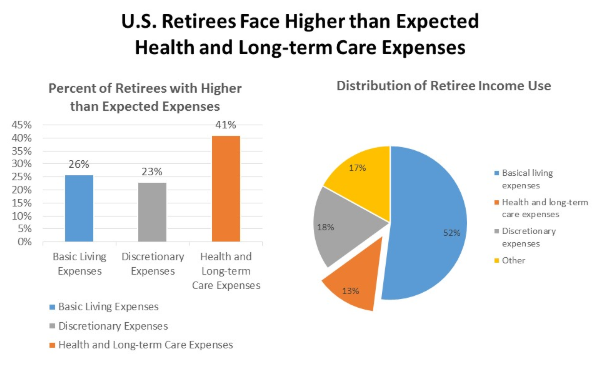

And don’t forget healthcare inflation — expected to hit 5.4% annually by 2026. That’s above general inflation and hits retirees hardest.

Social Security: Still Here, But Different

While Social Security isn’t running out in 2026, it’s inching toward a funding cliff.

Facts:

- Trust fund depletion expected in 2034, per SSA

- If Congress does nothing, benefits may be cut 20-25%

- COLA increases still help retirees cope with inflation — 2024 saw an 3.2% increase, and 2026 may bring another based on CPI-W data

The New Retirement Workforce

Don’t be surprised if your grandpa’s still working at 70 — because millions of Americans are delaying retirement due to:

- Healthcare costs

- Housing affordability

- Rising debt (yes, boomers have debt too!)

- Uncertainty around Social Security’s future

The labor participation rate for adults 65+ is projected to hit almost 25% by 2026, according to the Bureau of Labor Statistics.

And companies are responding: many are offering “phased retirement” or part-time consultant roles to experienced workers.

Practical Guide: How to Prep for the Turning Point for Retirement in the U.S. (and Beyond)

Here’s what you can start doing today:

1. Max Out Contributions

- 401(k): Up to $23,000 (plus $7,500 catch-up if 50+)

- IRA: $7,000 (plus $1,000 catch-up)

- Contribute early in the year to maximize compounding.

2. Diversify With Roth Accounts

Tax flexibility matters. If you’re not sure whether to go Roth vs. Traditional, consider this:

- Expect to be in a higher tax bracket later? Roth is better.

- Need a deduction today? Traditional may suit you.

Starting 2026, many employers will be defaulting to Roth 401(k)s — so best to get familiar now.

3. Build an HSA Strategy

Health Savings Accounts (HSAs) are triple-tax-advantaged:

- Tax-deductible contributions

- Tax-free growth

- Tax-free withdrawals for qualified medical expenses

In retirement, they’re gold for covering Medicare premiums, prescriptions, or long-term care.

4. Delay Social Security If Possible

Waiting until age 70 to claim can give you 76% higher monthly benefits than starting at 62. If you’re in good health and have other income sources, delay is often the smart play.

Why Some Taxpayers May Not See IRS Refunds Until March This Year

How the 2.8% COLA Adjustment Will Reshape Social Security Payments in 2026

$6,000 Senior Tax Exemption Sparks Debate Over Generational Fairness