Tax season often brings a mix of hope and anxiety. For many people, a tax refund is not just extra money, but a financial lifeline used to catch up on bills, pay off debt, or build a small safety net. That is why delays can feel frustrating and even worrying. Why some taxpayers may not see IRS refunds until March this year has become a common question, especially among early filers who expected faster results.

Why some taxpayers may not see IRS refunds until March this year is not about bad luck or poor timing alone. It is largely tied to how the tax system works, what the law requires, and how the IRS processes millions of returns under tight deadlines. What makes this issue more confusing is that some taxpayers get their refunds quickly while others wait weeks longer, even if they filed around the same time. The difference usually comes down to credits claimed, verification checks, filing methods, or small errors that slow things down. Understanding these factors can make the waiting period easier and help you avoid unnecessary stress.

When people search for why some taxpayers may not see IRS refunds until March this year, they are usually looking for clear answers, not technical jargon. The short explanation is that certain refunds are legally delayed, while others require extra review. The IRS must balance speed with accuracy and fraud prevention. Refunds that include specific credits, trigger identity checks, or contain errors are often held longer. Even taxpayers who file electronically and do everything right may still experience delays if their return falls into one of these categories. Most importantly, a delayed refund does not automatically mean a problem or an audit.

Table of Contents

Taxpayers May Not See IRS Refunds Until March This Year

| Delay Reason | What It Involves | How It Affects Timing |

|---|---|---|

| Earned Income Tax Credit | Mandatory fraud checks by law | Refunds released late February or March |

| Additional Child Tax Credit | Extra verification required | Refund processing slowed |

| Identity Verification | IRS confirms taxpayer identity | Refund released after confirmation |

| Filing Errors | Incorrect or missing information | Manual review adds weeks |

| Paper Filing | Manual data entry required | Longer processing time |

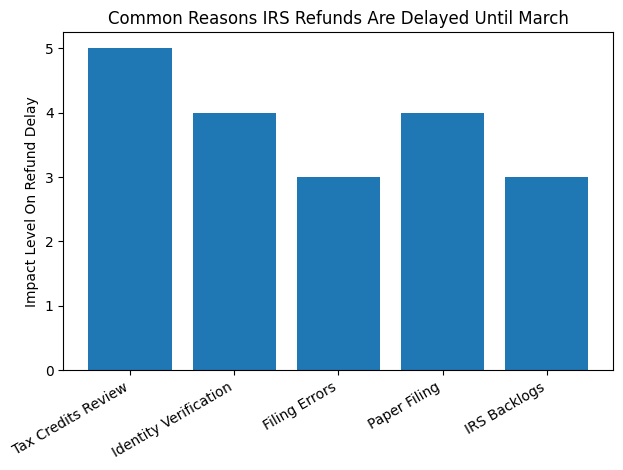

Refund Delays Linked To Tax Credits

One of the biggest reasons why some taxpayers may not see IRS refunds until March this year is refundable tax credits. Credits like the Earned Income Tax Credit and the Additional Child Tax Credit are designed to help low- and moderate-income households. Because these credits are frequently targeted by fraud, federal law requires the IRS to hold refunds that include them until additional checks are completed. This means that even if you filed on the first day of tax season and your return is perfectly accurate, the IRS cannot legally release your refund right away. These refunds are usually issued toward the end of February or into March. While this delay can be frustrating, it is part of a system meant to protect taxpayers and ensure benefits go to those who qualify.

Identity Verification and Fraud Prevention

Another major reason why some taxpayers may not see IRS refunds until March this year is identity verification. The IRS uses automated systems to flag returns that appear unusual or potentially fraudulent. This does not mean you did anything wrong. It could be something as simple as a change in income patterns, a new filing address, or past fraud linked to your Social Security number. When this happens, the IRS pauses processing and asks the taxpayer to verify their identity. This step may involve responding to a mailed notice or completing an online verification process. Until verification is complete, the refund is frozen. Responding quickly helps, but the process still adds time, often pushing refunds into March.

Errors That Trigger Manual Review

Small mistakes can cause big delays. Errors are one of the most overlooked reasons why some taxpayers may not see IRS refunds until March this year. Common issues include incorrect Social Security numbers, mismatched income information, missing forms, or calculation errors. When the IRS detects these problems, the return is pulled from automated processing and reviewed manually. Manual review takes significantly longer because an IRS employee must examine the return, request corrections if needed, and update the system. During peak tax season, manual reviews can take weeks, especially when millions of returns are being processed at the same time.

Paper Filing Vs Electronic Filing

- How you file your return matters more than many people realize. Paper returns take much longer to process because they require manual data entry before the IRS can even begin reviewing them. This alone can add several weeks to the timeline.

- Electronic filing, especially when combined with direct deposit, remains the fastest option. While e filing does not guarantee an immediate refund, it greatly reduces the chances of delays caused by data entry errors or misplaced paperwork. Taxpayers who still file by mail are far more likely to see refunds pushed into March or later.

IRS Processing Backlogs and Staffing Challenges

The IRS processes tens of millions of returns every tax season. Although the agency has improved efficiency compared to past years, staffing challenges and high workloads remain. Fraud prevention, customer service demands, and verification requirements all compete for limited resources. These operational pressures help explain why some taxpayers may not see IRS refunds until March this year, even when no issues exist with their returns. During peak season, even small slowdowns can ripple through the system and extend processing times.

How To Check Refund Status

- Waiting without information can make delays feel worse. Taxpayers can check refund status using official IRS tools, which typically update once per day. These tools show whether a return is received, approved, or sent.

- If the status indicates that additional information is needed, taking action quickly is essential. Delays often grow longer when notices are ignored or responses are slow. Staying proactive can prevent weeks of additional waiting.

What Taxpayers Can Do to Avoid Delays

While some delays are unavoidable, there are steps taxpayers can take to reduce the risk. Filing electronically, double checking all personal and income information, and choosing direct deposit can make a significant difference. Keeping records organized and comparing numbers with official forms also helps prevent errors. Another smart move is filing only when you have all necessary documents. Guessing income or rushing through the process often leads to mistakes that slow refunds. Being careful upfront saves time later.

Managing Expectations This Tax Season

- Understanding why some taxpayers may not see IRS refunds until March this year helps set realistic expectations. A delayed refund is usually not a sign of trouble. In most cases, it simply reflects required review processes or legal holds tied to specific credits.

- Planning ahead, avoiding reliance on early refunds, and staying informed can make tax season less stressful. While waiting is never ideal, knowing the reasons behind delays can provide peace of mind and help you stay financially prepared.

FAQs on Taxpayers May Not See IRS Refunds Until March This Year

Why Is My IRS Refund Taking Longer Than Expected

Refunds may be delayed due to tax credit reviews, identity verification, or errors that require manual processing.

Does Filing Early Guarantee A Faster Refund

Filing early helps, but refunds tied to certain credits are still legally delayed regardless of filing date.

How Long Do Refunds with Tax Credits Usually Take

Refunds that include certain refundable credits are often released in late February or March.

Can I Do Anything To Speed Up My Refund

You can reduce delays by e filing, choosing direct deposit, and responding quickly to IRS requests.