What It Really Takes to Retire at 65: She was 64, healthy, debt-free, and had $500K saved in a 401(k). She was confident she had enough. But five years into retirement, inflation hit, medical costs rose, and her roof started leaking. The truth hit hard—she needed nearly double what she thought. Linda’s story isn’t rare. Millions of Americans are heading toward retirement without knowing how much they’ll truly need, or how dramatically that number changes depending on where you live. This guide unpacks exactly what it takes to retire at 65 across all 50 U.S. states, with practical steps, official tools, and cold, hard numbers—served with a conversational touch that makes it easy to follow whether you’re 25 or 65.

Table of Contents

What It Really Takes to Retire at 65

Retirement is supposed to be your time to relax—not stress over money. But too many Americans are walking blind into retirement. Whether you’re dreaming of a beachside condo in Florida or a cabin in the Ozarks, you need to know what it’ll cost—and plan accordingly. If you’re behind on savings, don’t panic. You can:

- Work a few more years

- Delay Social Security

- Relocate to a cheaper state

- Cut unnecessary expenses

What matters most? Starting now. The earlier you understand your retirement number, the better your odds of living life on your terms at 65—and beyond.

| Topic | Key Info |

|---|---|

| Estimated cost of retirement at 65 | Ranges from ~$735K to ~$2.2M depending on the state |

| Median U.S. retirement savings | Only ~$200,000 for 65–74 age group |

| Most expensive state to retire | Hawaii: ~$2.2M needed |

| Most affordable state | Oklahoma: ~$735,000 needed |

| Social Security alone? | Covers only ~40% of retirement needs |

| Retirement calculators | Free at Fidelity and Vanguard |

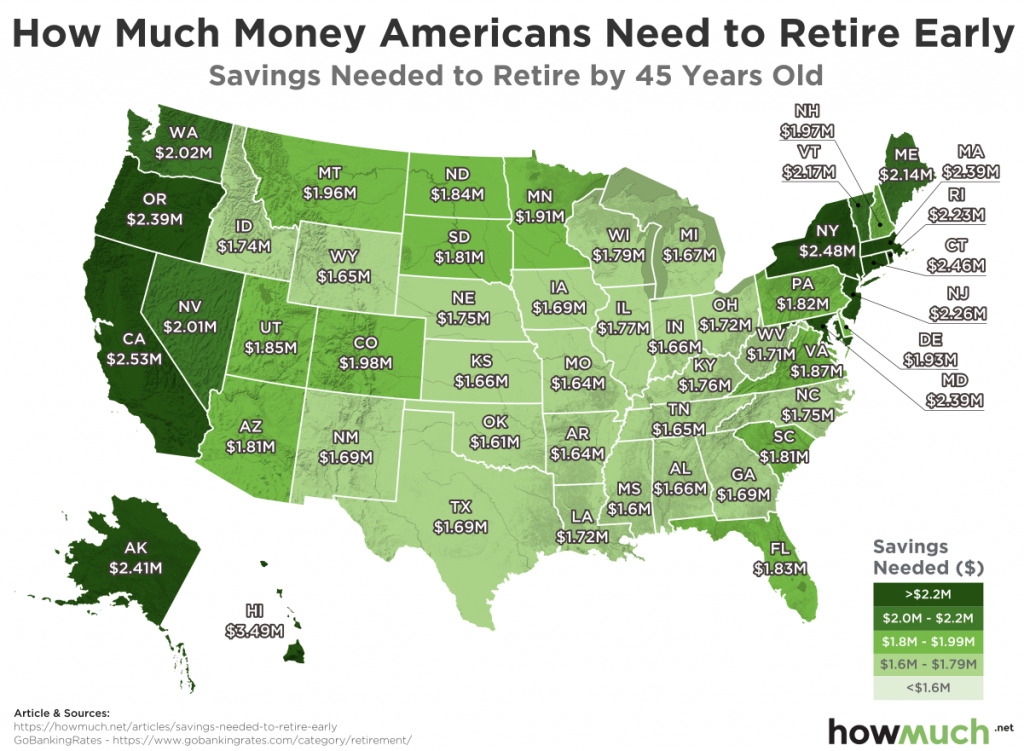

Why “Where You Retire” Changes Everything?

Retirement isn’t just about hitting a number. It’s about where you’ll live, what your lifestyle will look like, and how long your money will last.

Living in California vs. Tennessee can mean a difference of over $500,000 in retirement savings needed—just because of housing costs, taxes, and insurance premiums.

Four key factors affect your cost to retire by state:

- Housing costs – whether you rent or own with a mortgage matters.

- Healthcare costs – even with Medicare, out-of-pocket costs vary.

- Taxes – state income taxes, property taxes, and whether Social Security is taxed.

- Cost of living – groceries, gas, utilities, and services fluctuate significantly.

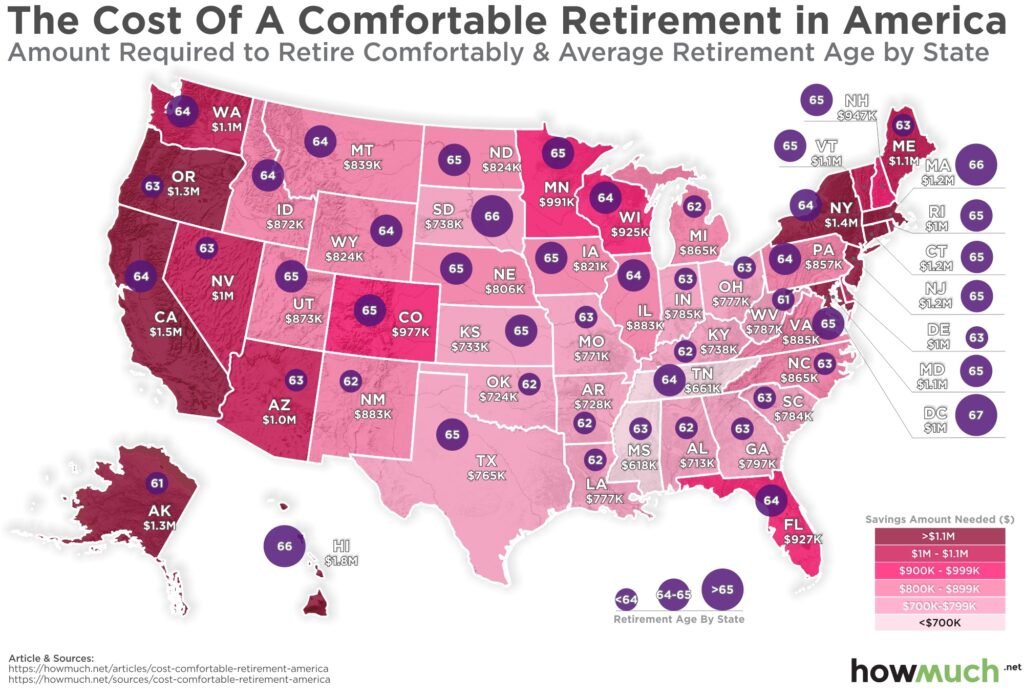

What It Really Takes to Retire at 65: State-by-State Retirement Cost Comparison

Below are select examples that show how retirement savings needs can swing widely across the U.S.

Most Affordable States

| State | Annual Expenses | Savings Needed (Assuming 25-Year Retirement) |

|---|---|---|

| Oklahoma | ~$51,800 | ~$735,000 |

| Mississippi | ~$52,500 | ~$752,000 |

| Kansas | ~$54,600 | ~$804,000 |

| Arkansas | ~$54,200 | ~$810,000 |

| West Virginia | ~$53,000 | ~$792,000 |

Why they’re cheap: These states have relatively low housing, healthcare, and utility costs. Property taxes and insurance tend to be manageable, too.

Mid-Range Cost States

| State | Annual Expenses | Savings Needed |

|---|---|---|

| Florida | ~$61,100 | ~$967,000 |

| Texas | ~$55,700 | ~$833,000 |

| North Carolina | ~$59,800 | ~$934,000 |

| Colorado | ~$63,400 | ~$1.01M |

| Utah | ~$60,800 | ~$996,000 |

These states are popular retirement destinations, but rising housing prices and healthcare costs push their affordability into the mid-tier range.

Most Expensive States

| State | Annual Expenses | Savings Needed |

|---|---|---|

| Hawaii | ~$110,300 | ~$2.2M |

| Massachusetts | ~$92,600 | ~$1.75M |

| New York | ~$77,700 | ~$1.38M |

| California | ~$69,500 | ~$1.18M |

| Oregon | ~$68,600 | ~$1.15M |

In these states, housing, taxes, and insurance costs are the primary drivers of higher savings requirements. Even with Medicare, medical services and premiums are often higher.

What Most Americans Have Saved to Retire at 65?

This is where the math gets tricky—and frankly, scary.

According to the Federal Reserve’s SCF data:

- The median retirement savings for Americans aged 65–74 is only around $200,000.

- That’s less than 20% of what’s needed to retire comfortably in Hawaii.

- Even in low-cost states, many retirees still fall short.

This retirement gap is one reason why 63% of Americans fear outliving their savings, according to a recent Northwestern Mutual study.

How to Calculate What You Need to Retire at 65?

The “how much do I need to retire?” question isn’t one-size-fits-all.

Here’s a simple formula that works:

Step-by-Step Formula

- Start with your projected annual retirement expenses.

Example: $60,000/year - Subtract expected Social Security income.

Example: $20,000/year from SSA - The gap is what your savings must cover.

$40,000/year shortfall - Multiply by 25 (for 25 years in retirement).

$40,000 × 25 = $1 million needed

This method follows the 4% safe withdrawal rule, a guideline for withdrawing 4% of your savings annually without running out of money.

Don’t Forget Healthcare

Even with Medicare, you’ll still face substantial costs.

- Fidelity estimates a 65-year-old couple retiring in 2023 will need about $315,000 just to cover medical expenses.

- Medicare doesn’t cover dental, hearing, or vision.

- Long-term care (nursing homes or in-home care) can cost $50K to $100K+ annually, often not covered by Medicare.

Tip: Consider a Health Savings Account (HSA) if you’re still working—it grows tax-free and can be used for qualified medical expenses in retirement.

The Tax Trap: Best and Worst States

Best States for Tax-Friendly Retirement

| State | Perks |

|---|---|

| Florida | No income tax |

| Nevada | No state tax + low property tax |

| Wyoming | No income tax, low cost |

| Pennsylvania | No tax on retirement income or Social Security |

| South Dakota | No income tax + affordable healthcare |

Worst for Retirees

| State | Downsides |

|---|---|

| California | High income + property taxes |

| Vermont | Taxes Social Security income |

| Connecticut | Expensive housing + healthcare |

| Minnesota | Taxes most retirement income |

| New York | High overall cost of living |

Choosing a state based solely on taxes isn’t always wise—but it can make a big difference if your retirement income is taxable.

What It Really Takes to Retire at 65: Common Mistakes to Avoid

- Underestimating inflation.

Retirees living off fixed incomes suffer most when prices rise. Include 3–4% inflation buffer in your planning. - Not accounting for longevity.

If you live past 90, will your money last? Plan for a 30-year retirement, not 20. - Ignoring housing transitions.

Selling your home? Downsizing? Renting? These all impact how far your money will go. - Assuming Medicare covers everything.

It doesn’t. Period. Budget $6,000–10,000 per year per person for out-of-pocket expenses.

Social Security Payments Could Reach $5,430 a Month in 2026 — Here’s How

How the 2.8% COLA Adjustment Will Reshape Social Security Payments in 2026

IRS Confirms an Online Step That Could Reduce Your Tax Bill by Up to Half