Defaulted Student Loan Borrowers Could Lose Tax Refunds: and for millions of Americans, that could mean missing out on critical income just when they need it most. After a multi-year pause triggered by the COVID-19 pandemic, the federal government is restarting collections on defaulted federal student loans, and one of the first tools they’re bringing back? Seizing tax refunds through the Treasury Offset Program (TOP). For borrowers in default — those who haven’t made payments in 270 days or more — this season might be their first encounter with federal tax refund garnishment in years. In this in-depth guide, we break down everything: the laws behind it, who’s at risk, how to check your status, and what you can do right now to keep your tax refund safe.

Table of Contents

Defaulted Student Loan Borrowers Could Lose Tax Refunds

Millions of Americans are walking into tax season not realizing that a defaulted student loan could drain their refund, thanks to the Treasury Offset Program. Even with temporary protections in place, the risk is real — and the window to act is closing. But the good news? If you check your loan status now, enter rehabilitation or consolidate, and take the right steps, you can protect your tax refund, stay out of collections, and start rebuilding your financial footing.

| Topic | Details / Data |

|---|---|

| What’s happening | Borrowers with defaulted federal student loans are at risk of having their federal tax refunds seized via the Treasury Offset Program. |

| Default status | Loans go into default after 270+ days of missed payments. |

| How refunds are seized | Refunds are intercepted before payment, including Earned Income Tax Credit (EITC) and Child Tax Credit (CTC). |

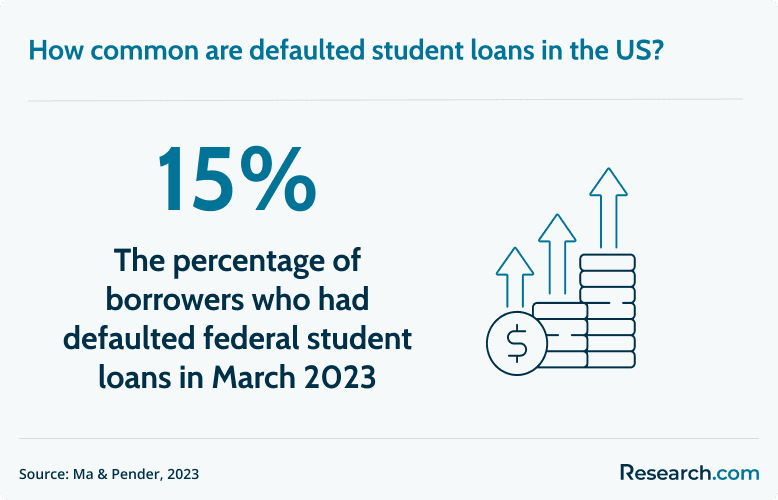

| Estimated # in default | ~5.5 million borrowers as of late 2025. |

| Temporary pause | Involuntary collections paused for early 2026, but may resume without notice. |

| How to avoid seizure | Check loan status, rehabilitate or consolidate, call TOP hotline: 1‑800‑304‑3107. |

What Is Student Loan Default and Why It Matters?

Let’s keep it real — not paying your student loans doesn’t make you a bad person. Life happens. Medical emergencies, job loss, or inflation can derail even the most responsible borrower.

But from a legal and policy perspective, when your federal student loan goes unpaid for 270 days, it is considered in default.

Default kicks off a chain reaction:

- Your loan gets transferred to the Department of Education’s collections unit or a private collector.

- You lose eligibility for federal benefits like deferment, forbearance, or IDR (income-driven repayment).

- Your wages, tax refunds, and Social Security benefits become fair game for seizure.

The government can do this without going to court. That’s because they have special powers under federal law, unlike private creditors.

What Is the Treasury Offset Program (TOP)?

TOP is a federal debt collection program run by the Bureau of the Fiscal Service, part of the U.S. Treasury Department.

If a borrower’s loan is in default, the Department of Education can refer the debt to TOP, which then scans federal payments (like tax refunds) and intercepts them to pay off debts.

This includes:

- Federal income tax refunds

- Social Security payments

- Vendor or contractor payments

- Some federal retirement benefits

Even if you’re eligible for low-income refundable tax credits like the Earned Income Tax Credit (EITC), the entire refund amount can be taken.

There is no second warning once your debt is certified to TOP — the refund is intercepted automatically.

2026 Tax Season Context: Why Defaulted Student Loan Borrowers Could Lose Tax Refunds

During the pandemic, the government paused federal student loan collections, defaults, interest accrual, and offsets. From March 2020 to late 2023, borrowers weren’t subject to TOP or wage garnishments.

But now, as part of the return-to-repayment strategy, the Department of Education restarted collections in stages.

In January 2026, the Department announced a temporary pause on tax refund seizures and wage garnishment to allow borrowers more time to get back on track with new repayment options like SAVE (Saving on a Valuable Education Plan).

However:

- This pause is not permanent.

- Refund seizures may resume mid-season, depending on policy updates.

- Millions of borrowers may not even know they’re in default.

If you don’t act during this window, you may be in for a nasty surprise come refund time.

How to Check If Defaulted Student Loan Borrowers Could Lose Tax Refunds?

- Log in to Studentaid.gov with your FSA ID.

- Check loan status under “My Aid.”

- Look for words like “Default”, “Collections”, or “Delinquent.”

- Call the Treasury Offset Program Call Center at 1-800-304-3107.

- Ask if you’re on the TOP offset list.

- This line is open 8 a.m. to 8 p.m. Eastern, Monday through Friday.

- Check your mail. The government is supposed to send a pre-offset notice, but if you’ve moved or ignored collection letters, you might’ve missed it.

What to Do If You’re a Defaulted Student Loan Borrowers Could Lose Tax Refunds?

If you’re in default and want to protect your refund:

1. Rehabilitate Your Loan

- Set up a loan rehabilitation agreement with your servicer.

- Make 9 consecutive, on-time payments (based on income).

- After completion, your loan exits default and offset risk disappears.

2. Consolidate the Loan

- Apply for a Direct Consolidation Loan via studentaid.gov.

- This pays off your defaulted loan and combines it into a new one.

- You’ll need to agree to repay under an income-driven plan.

Important: Consolidation can happen faster than rehab, which takes 9 months. But rehab can remove the default from your credit report — something consolidation doesn’t do.

What About Joint Filers and Injured Spouse Relief?

If you’re married and filing jointly, your spouse’s portion of the refund can also be intercepted unless you act.

Injured Spouse Allocation:

You can file IRS Form 8379 (Injured Spouse Allocation) to recover the portion of the refund owed to the non-defaulted spouse. It’s crucial to:

- Submit the form with your tax return or soon after.

- Be prepared for processing to take 8–14 weeks.

Lawsuits and Legal Challenges Around Refund Offsets

In 2024, several borrower advocacy groups filed lawsuits challenging aggressive collection tactics on defaulted borrowers without clear notice or recertification.

Some lawsuits argue:

- The Department is violating due process by resuming offsets without updating borrower contact info.

- Low-income families are being disproportionately impacted by losing essential credits like EITC.

While these lawsuits haven’t stopped TOP outright, they may influence future policy or strengthen borrower protections.

Protecting Your Finances Going Forward

To avoid future surprises:

- Sign up for Income-Driven Repayment (IDR) if not already.

- Explore the SAVE plan, which offers $0 monthly payments for many low-income borrowers.

- Set calendar reminders for annual IDR recertification to stay out of delinquency.

- Maintain a current mailing address and email in your loan profile.

Also consider keeping a separate savings buffer in case of collection restarts.

How the 2.8% COLA Adjustment Will Reshape Social Security Payments in 2026

$6,000 Senior Tax Exemption Sparks Debate Over Generational Fairness

Why 2026 Is Shaping Up to Be a Turning Point for Retirement in the U.S.