Social Security payments for a limited number of U.S. retirees could approach $5,430 per month in 2026, based on current benefit formulas, projected wage growth, and expected cost-of-living adjustments. The figure represents the system’s maximum possible monthly retirement benefit, not a typical payment, and reflects decades of high earnings combined with delayed benefit claims.

Table of Contents

Social Security Payments

| Key Fact | Detail |

|---|---|

| Projected maximum monthly benefit (2026) | Approximately $5,430 |

| Claiming age required | Age 70 |

| Earnings requirement | 35 years at or near taxable maximum |

| Applies to | A small minority of retirees |

| Average retiree benefit | Less than half of the maximum |

What the $5,430 Figure Actually Means

The prospect of Social Security payments reaching $5,430 per month has attracted attention, but the number requires careful explanation. It does not signal a policy change, nor does it imply that benefits for most retirees are rising to that level.

Instead, the figure reflects the upper boundary of what the Social Security system allows under existing law. Each year, the program adjusts benefit calculations based on wage growth and inflation. When these adjustments are applied to the highest allowable earnings and combined with delayed retirement credits, the resulting maximum benefit increases incrementally over time.

The $5,430 estimate assumes no major legislative changes and a continuation of recent economic trends. It is a projection, not a guarantee.

How Social Security Payments Are Determined

Lifetime Earnings and the 35-Year Rule

At the core of the Social Security system is a worker’s earnings record. Benefits are calculated using the 35 highest-earning years of a person’s career, adjusted for changes in average wages across the economy.

Workers who earn less than the annual taxable maximum, experience career gaps, or spend extended periods outside the workforce accumulate lower lifetime averages. In contrast, individuals who consistently earn at or above the taxable cap for at least 35 years position themselves for higher benefits.

Earnings above the annual cap do not count toward benefit calculations, which places a ceiling on how much income can influence future payments.

The Importance of Claiming Age

Claiming age is one of the most significant factors shaping Social Security payments.

- Benefits claimed at age 62 are permanently reduced.

- Benefits claimed at full retirement age provide the standard amount.

- Benefits claimed at age 70 receive the maximum possible monthly increase through delayed retirement credits.

For each year benefits are delayed beyond full retirement age, monthly payments rise by approximately 8 percent, up to age 70. This increase compounds with cost-of-living adjustments over time.

For high earners, delaying benefits is often the decisive step that moves payments closer to the system’s maximum.

Why Most Retirees Will Never Reach the Maximum

Despite frequent headlines, only a small share of Americans are likely to receive Social Security payments near $5,430.

Several structural factors limit eligibility:

- Many workers do not earn at the taxable maximum for 35 years.

- A majority of retirees claim benefits before age 70.

- Health limitations and job availability often influence earlier claiming decisions.

- Women and caregivers are more likely to have interrupted work histories.

As a result, the average retired worker benefit remains far below the maximum. The gap between typical payments and the highest possible benefit highlights long-standing disparities in earnings and employment patterns.

Historical Perspective: How Maximum Benefits Have Changed

The steady rise in maximum Social Security payments reflects broader economic trends rather than sudden generosity.

Over past decades, maximum benefits have increased due to:

- Rising national wage averages

- Inflation-driven cost-of-living adjustments

- The introduction of delayed retirement credits in the 1980s

When adjusted for inflation, the growth of maximum benefits has been gradual. What appears to be a dramatic number today reflects cumulative changes spread across multiple decades.

This historical context underscores why comparisons across eras can be misleading without adjusting for purchasing power and wage growth.

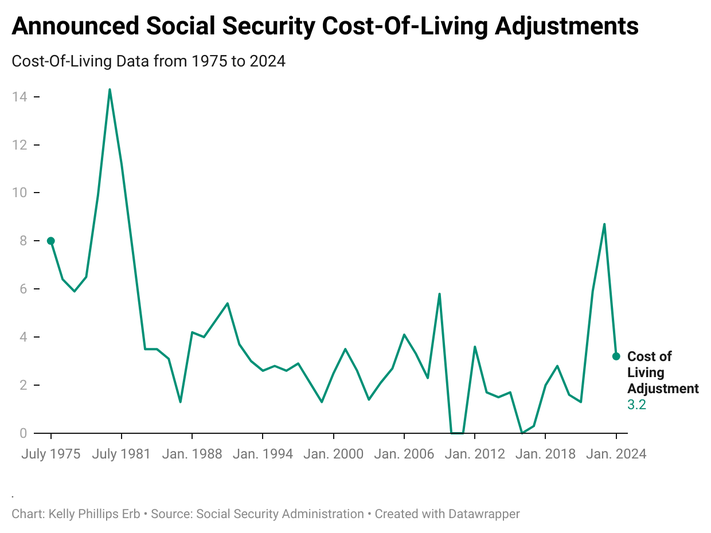

Cost-of-Living Adjustments and Their Role in 2026

How COLA Works

Cost-of-living adjustments are intended to preserve purchasing power, not increase real income. They are based on changes in consumer prices and applied uniformly to all beneficiaries.

For high earners, COLAs compound on already large base benefits, amplifying dollar increases over time. For lower-income retirees, the same percentage increase results in smaller absolute gains.

The projected $5,430 figure assumes moderate inflation consistent with recent trends. A lower inflation environment would reduce that projection, while higher inflation could push it slightly higher.

Real-World Scenarios: Who Might Qualify?

Scenario One: The Career Executive

A worker who earns at or above the taxable maximum from their early 30s through retirement, remains continuously employed, and delays claiming until age 70 could approach the projected maximum.

Such individuals often include senior executives, specialized professionals, and long-tenured employees in high-paying sectors.

Scenario Two: The Late High Earner

A worker whose earnings peak later in life may still fall short. Because benefits rely on 35 years of earnings, even a decade of high income may not offset earlier lower wages.

This structure favors consistency over late-career success.

Scenario Three: The Early Claimant

Even high earners who claim benefits early permanently reduce their payments. For these individuals, monthly benefits can fall thousands of dollars below the maximum.

These examples illustrate how the system rewards timing and longevity as much as income.

Common Misconceptions About Social Security Payments

Misconception 1: “Benefits Are Rapidly Increasing for Everyone”

In reality, average benefits rise slowly and are largely offset by inflation. The maximum benefit grows faster in dollar terms because it starts from a higher base.

Misconception 2: “High Benefits Mean the System Is More Generous”

The system remains constrained by strict formulas and funding limits. High benefits reflect high contributions over decades, not expanded generosity.

Misconception 3: “The Maximum Benefit Is the Target”

Social Security was designed as income support, not full retirement income replacement. Even the maximum benefit often represents only a portion of pre-retirement earnings for high-income workers.

Funding Pressures and Long-Term Sustainability

The discussion around large Social Security payments occurs against the backdrop of broader financial challenges facing the program.

Demographic shifts—including longer life expectancy and lower birth rates—have reduced the ratio of workers to beneficiaries. Without changes, projected trust fund shortfalls could eventually require benefit adjustments.

These long-term concerns do not affect near-term payments but remain central to policy debates in Washington.

Policy Debates and Potential Reforms

While no immediate changes are scheduled, policymakers continue to debate reforms that could affect future beneficiaries, including:

- Raising or eliminating the taxable earnings cap

- Adjusting benefit formulas for high earners

- Increasing full retirement age

- Modifying cost-of-living adjustments

Any such changes would likely apply gradually and spare current retirees, but they could reshape who qualifies for maximum benefits in future decades.

Why the $5,430 Figure Still Matters

Even if few retirees ever receive Social Security payments near $5,430, the number remains symbolically important.

It highlights:

- The widening gap between high and average earners

- The importance of claiming decisions

- The growing role of Social Security in retirement planning

For policymakers, it underscores the system’s redistributive structure. For individuals, it reinforces the trade-offs between working longer, claiming later, and relying on other retirement savings.

Closing Context

As projections for 2026 take shape, Social Security payments near $5,430 will remain the exception rather than the rule. The figure reflects decades of earnings, delayed retirement, and compounding adjustments—an outcome achievable by design, but only by a narrow slice of the workforce.