For several years, federal student loan borrowers experienced something that once seemed impossible: collections stopped. Paychecks were protected, tax refunds weren’t intercepted, and people who had fallen behind on their loans finally had time to breathe.

That relief is ending. student loan wage garnishment 2026 is now moving from a warning to a reality, and many borrowers are unprepared for how quickly it can affect their income. The return of student loan wage garnishment 2026 means the government can once again take a portion of wages directly from workers who have defaulted federal student loans. The biggest surprise for many people is who will actually be affected. This is not mainly about recent graduates who just missed a payment or two. Most people at risk left school years ago. Some changed jobs, moved cities, or assumed the debt had disappeared during the payment pause. Others never logged into their loan account again. Now that collections are restarting, these borrowers may receive notices or even see reduced paychecks without realizing their loan status had already moved into default.

The term student loan wage garnishment 2026 refers to the federal government restarting administrative collections on defaulted student loans. A loan typically enters default after about 270 days of nonpayment. Once that happens, the Department of Education has the authority to order an employer to deduct money directly from a borrower’s paycheck. Unlike most other debts, the government does not need to sue first. Borrowers are sent a warning notice and a chance to resolve the debt, but if no action is taken, deductions begin automatically. Understanding this process early is critical because preventing garnishment is far easier than stopping it later.

Table of Contents

Student Loan Wage Garnishment Returns in 2026

| Key Detail | Information |

|---|---|

| Policy Change | Restart of federal student loan collections |

| Affected Borrowers | Loans in default (around 9 months without payment) |

| Garnishment Amount | Up to 15% of disposable income |

| Court Order Needed | No |

| Advance Notice | Yes, warning letter before deductions |

| Prevention Options | Rehabilitation, consolidation, repayment plans |

| Other Collection Tools | Tax refund offset and benefit offset |

| Highest Risk Group | Long-term non-paying borrowers |

The return of collections does not affect every borrower, but it affects enough people to matter nationally. Millions of Americans still have loans in default, and many are unaware of their status. The most important message is simple: garnishment is preventable. The government generally offers repayment solutions before taking wages. Borrowers who respond early almost always have options. Student loan wage garnishment 2026 becomes a problem primarily when borrowers ignore notices or assume nothing will happen. Communication and action are what protect paychecks.

What Wage Garnishment Actually Means

- When student loan wage garnishment 2026 affects someone, it changes their finances immediately. Employers receive a legal withholding order from the federal government and must comply. Payroll departments cannot negotiate or delay it. They simply deduct the required amount from each paycheck and send it to the Department of Education.

- This process is called administrative wage garnishment. It is very different from private debt collection. Credit card companies or private lenders must first file a lawsuit and win a judgment. Federal student loans are different. The government already has collection authority written into federal law.

- The deduction is taken from disposable income earnings left after mandatory taxes. The government can withhold up to 15 percent. For someone earning the equivalent of $3,200 per month after taxes, roughly $480 could be taken each month. For many households, that amount equals rent, transportation costs, or groceries.

Who Could Be Affected First

- One of the most misunderstood parts of student loan wage garnishment 2026 is who it impacts first. The group at highest risk is not young graduates. It is borrowers who have been out of school for years.

- Long-term defaulters are at the top of the list. Many stopped paying before 2020 and never resumed after the pause. Some believed forgiveness would automatically apply to them. Others simply lost track of their servicer.

- Borrowers who never updated their contact information are also vulnerable. Collection warnings are mailed. If the address on file is outdated, the notice may never reach them.

- Low-income workers are another major group affected. Ironically, many could qualify for extremely low monthly payments through income-driven repayment plans, but because they never enrolled, their loans remained in default.

- Parents with Parent PLUS loans are increasingly appearing in default statistics as well. Some borrowed to help their children attend college and are now approaching retirement while facing garnishment risk.

Why Garnishment Is Returning Now

- The return of collections did not happen suddenly. The payment pause was always temporary emergency relief. Eventually, federal law required loan programs to return to normal administration. There are three primary reasons the government is restarting enforcement.

- First, federal student loans are public funds, and the Department of Education is required to recover defaulted balances whenever possible. Second, pandemic protections expired. Third, many borrowers still did not resume payments after repayment restarted.

- As a result, student loan wage garnishment 2026 represents a policy shift back to standard loan collection procedures rather than a new penalty.

How Borrowers Will Be Notified

- Before deductions begin, borrowers should receive an official written notice. The letter typically explains the total balance owed, the proposed deduction amount, and the deadline to respond. It also explains the right to request a hearing.

- Borrowers usually have about 30 days to act. This period is extremely important. During this window, a borrower can enroll in a repayment option, request hardship consideration, or begin rehabilitation.

- Many people mistakenly ignore the letter, assuming it is just another collection warning. In reality, it is the final step before student loan wage garnishment 2026 begins.

Ways To Stop Wage Garnishment

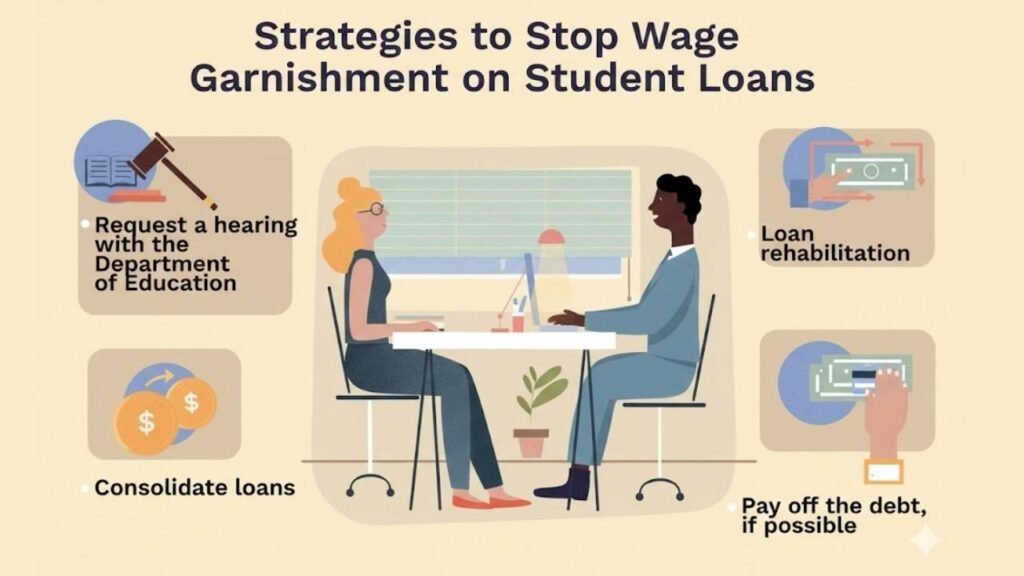

The good news is that wage garnishment can often be prevented. Even borrowers already in default still have several solutions.

- Loan rehabilitation is one of the most effective. The borrower agrees to make a set number of affordable monthly payments based on income. After completing the program, the loan leaves default and collections stop.

- Loan consolidation is faster. A new federal consolidation loan replaces the defaulted loan and restores good standing.

- Income-driven repayment plans are another option. These plans adjust payments according to earnings and family size. Some borrowers qualify for payments as low as zero dollars per month.

- Borrowers may also request a hardship hearing if garnishment would prevent them from meeting basic living expenses.

- Acting early greatly increases the chances of avoiding student loan wage garnishment 2026.

Additional Consequences Beyond Paychecks

- Wage withholding is only one part of the federal collection system. Borrowers in default may also experience tax refund interception. Federal tax refunds can be taken and applied to loan balances.

- Social Security benefits may also be reduced for older borrowers. Additionally, default severely damages credit scores, making mortgages, car loans, or even apartment applications difficult.

- Collection fees may also be added, increasing the overall balance.

What Borrowers Should Do Right Now

- Anyone unsure about their loan status should check immediately. The first step is logging into their federal student aid account and confirming whether loans are current, delinquent, or in default.

- Next, borrowers should update their mailing address, email, and phone number to ensure they receive notices.

- Contacting the loan servicer is crucial. Representatives can explain repayment options and eligibility for rehabilitation programs.

- Waiting until paychecks shrink makes the situation far harder to fix. Many people only react once deductions begin, but by then student loan wage garnishment 2026 has already started affecting their income.

The Bigger Picture

- The pandemic pause was one of the largest financial relief efforts in higher education history. However, the economic environment has changed. Living costs have increased, and many households are financially stretched.

- Because of this, the restart of collections may feel more difficult than before 2020. Financial counselors now emphasize awareness as the most important protection borrowers have. Checking loan status takes minutes but can prevent months of lost income.

FAQs on Student Loan Wage Garnishment Returns in 2026

What Percentage of My Paycheck Can Be Taken?

Up to 15 percent of disposable income can be withheld for federal student loan collections.

Do Federal Loans Require a Court Judgment?

No. The government can garnish wages administratively without filing a lawsuit.

Can Garnishment Be Stopped After It Begins?

Yes. Loan rehabilitation or consolidation can stop collections, though acting earlier is easier.

Will My Employer Know the Details of My Debt?

Employers receive a legal withholding order but typically only know it is a federal collection requirement.