The debate over $2000 Stimulus Checks Funded by Tariffs has intensified after U.S. political leaders floated a plan to send direct payments to Americans using import-tax revenue. As of February 2026, however, no legislation authorizing the payments has passed Congress, and federal agencies say no checks are scheduled. Economists remain divided over whether such a program is financially viable and whether households would ultimately benefit.

Table of Contents

$2000 Stimulus Checks Funded by Tariffs

| Key Fact | Detail/Statistic |

|---|---|

| Payment status | No federal law authorizes payments |

| Estimated cost | Roughly $280B–$600B |

| Funding idea | Revenue from tariffs on imported goods |

Understanding the Proposal: $2000 Stimulus Checks Funded by Tariffs

The plan centers on what supporters call a “tariff dividend.” The concept proposes distributing federal tariff revenue directly to households, similar to a rebate.

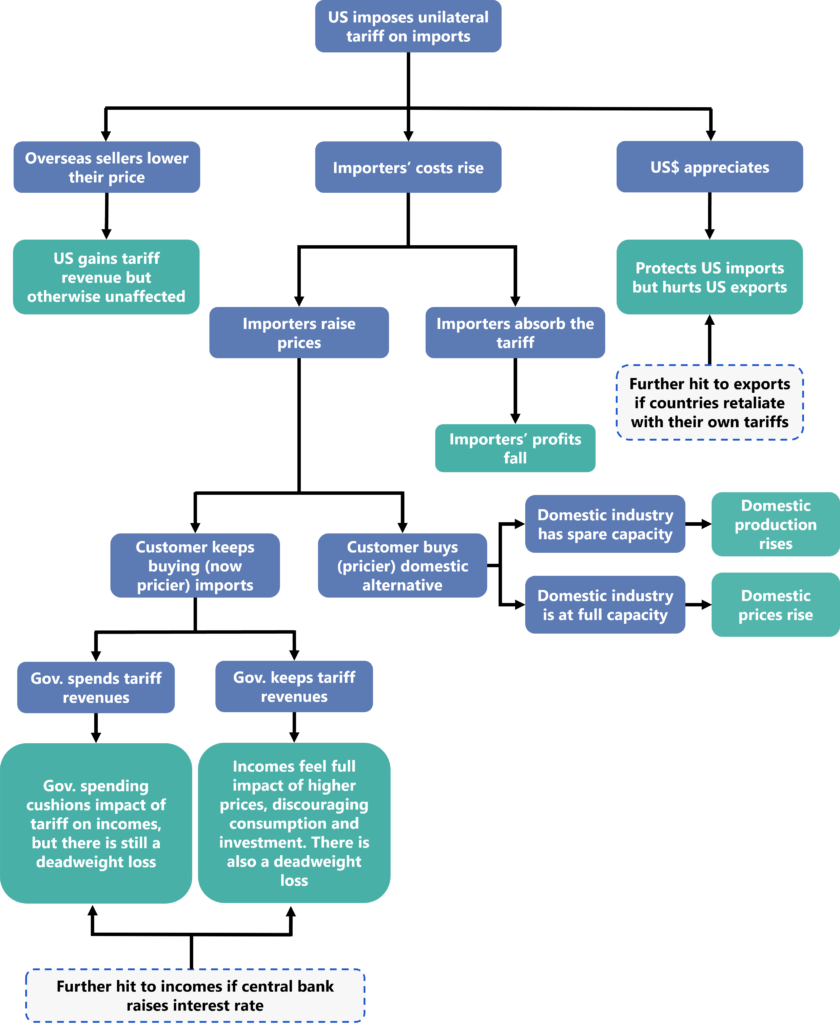

Tariffs are taxes imposed on imported goods. When companies import products into the United States, they pay the federal government. Advocates argue that increasing tariffs could create a revenue stream large enough to fund payments to citizens.

Former U.S. officials and allied policymakers have publicly discussed sending payments of about $2,000 per eligible resident. Supporters say the approach could offset rising living costs without expanding government borrowing.

But federal agencies have emphasized that the proposal remains hypothetical. According to reporting across major U.S. outlets citing the Internal Revenue Service (IRS), the government has not opened any application, registration, or payment system.

Officials also note that any genuine federal payment program would be announced through official government channels, including Treasury Department communications and IRS notices.

How $2000 Stimulus Checks Funded by Tariffs Work

Who actually pays tariffs?

Economists note that tariffs are paid by importing companies, not foreign governments. However, the costs often move through the supply chain.

Dr. Erica York, an economist with the Tax Foundation, explained in policy analysis frequently cited in national reporting:

“Tariffs typically raise prices for domestic consumers because importers pass costs along through higher retail prices.”

Retailers adjust pricing to protect margins. Manufacturers using imported components may also increase prices.

For example, tariffs on electronics parts can increase the price of smartphones, computers, and automobiles. That is why economists focus on consumer inflation when evaluating a tariff-funded payment plan.

Funding Questions

A major issue is financial feasibility.

Estimates suggest sending $2,000 to most Americans would cost hundreds of billions of dollars annually. Even aggressive tariff policies currently generate far less revenue than required.

Budget analysts interviewed by financial publications say tariff collections fluctuate and depend heavily on trade volumes. If imports decline due to higher costs, revenue would also fall.

Douglas Holtz-Eakin, president of the American Action Forum and former Congressional Budget Office director, has warned in public commentary:

“You cannot reliably fund a permanent entitlement using a volatile revenue source.”

Supporters counter that tariffs could expand significantly if broader trade measures are adopted. Some policymakers argue that increased domestic production could partially offset higher consumer prices.

Legal and Political Hurdles

The proposal faces several procedural steps before any payments could occur:

- Congress must draft and pass legislation

- The president must sign the bill into law

- Federal agencies must implement eligibility rules

No such bill has been introduced or approved at the federal level.

The IRS has also warned indirectly through public messaging that Americans should be cautious of online registration offers tied to stimulus payment rumors. Historically, official payments are sent automatically using tax filings and Social Security records.

Comparison With Pandemic Stimulus Payments

During 2020-2021, Congress approved three rounds of pandemic stimulus payments under emergency legislation. Those payments were funded through federal borrowing and relief packages designed to prevent economic collapse.

The tariff-funded proposal differs in several ways:

- Intended to rely on tax revenue instead of government borrowing

- Not tied to a recession or national emergency

- Could potentially be recurring instead of temporary

Economists say that distinction is important. Pandemic stimulus aimed to boost spending during shutdowns. The tariff dividend would be a structural fiscal policy, not emergency aid.

Economic Debate

Supporters’ Argument

Supporters say the policy could redistribute trade revenue to citizens while encouraging domestic manufacturing. They believe higher import costs may shift production back to the United States.

Some trade advocates argue the policy would create a “closed economic loop”: tariffs collected from imports would flow directly to households.

Critics’ Concerns

Critics warn the policy may increase inflation.

Trade economists note that tariffs historically function as a consumption tax. If prices rise, households could effectively pay for their own stimulus checks.

The Peterson Institute for International Economics has previously concluded in trade research that tariffs tend to reduce purchasing power across the economy.

Historical Context: Tariffs and American Policy

Tariffs once funded a large portion of the U.S. federal government. During the 19th century, before income taxes existed, customs duties were a primary revenue source.

However, after the introduction of the federal income tax in 1913, tariffs became a smaller part of government funding.

Economic historians often point to the Smoot-Hawley Tariff Act of 1930, which raised tariffs dramatically during the Great Depression. Many economists believe it worsened global trade declines, although historians still debate its full impact.

This history shapes modern caution. Policymakers must weigh domestic industry protection against international trade retaliation.

International Reactions and Trade Implications

The proposal could affect global trade relations.

Trading partners typically respond to tariffs with counter-tariffs. That can affect industries such as agriculture, automobiles, and technology exports.

For example, in previous tariff disputes, U.S. farmers experienced reduced exports after foreign countries imposed retaliatory duties.

Trade policy specialists say a large tariff expansion linked to direct payments could trigger broader negotiations or disputes at the World Trade Organization.

Impact on Households

For households, the key question is simple: Would families be financially better off?

Economists say the answer depends on three variables:

- Size of the payment

- Increase in consumer prices

- Frequency of payments

If prices rise faster than payments, households may not gain purchasing power.

Low-income households might benefit more because they spend a larger share of income on essential goods. However, they also feel price increases more strongly.

Current Status

As of February 2026:

- No federal stimulus legislation exists

- No payment date is scheduled

- No eligibility criteria are finalized

Government agencies have not confirmed any upcoming payment. The discussion remains a policy proposal rather than an implemented program.

Public Confusion and Online Rumors

The discussion has also led to widespread misinformation online.

Cybersecurity experts warn that viral posts promising application portals or early enrollment are likely scams. Fraud attempts typically request Social Security numbers, bank details, or payment processing fees.

Consumer protection officials say legitimate federal payments never require advance fees or registration through unofficial websites.

Outlook

For now, the idea of $2000 Stimulus Checks Funded by Tariffs remains part of a broader policy debate about trade, inflation, and government spending. Analysts expect the topic to reappear during election-year economic discussions and federal budget negotiations.

A senior budget researcher recently summarized the situation:

“The proposal is politically appealing but economically complex. The real question is whether tariff revenue can sustain predictable payments without raising prices.”

Until legislation is drafted and approved, the payments remain theoretical rather than imminent.

FAQs About $2000 Stimulus Checks Funded by Tariffs

Are $2000 stimulus checks approved?

No. Congress has not authorized any payments.

Can people apply online?

No official application exists.

Who would qualify if passed?

Eligibility rules have not been written.

When could payments happen?

Only after legislation passes Congress and agencies implement rules, which typically takes months.

Would non-taxpayers receive payments?

Unknown. Lawmakers have not finalized eligibility criteria.