What Happens to Your Social Security Check: Retiring abroad is no longer just a fantasy for dreamers—it’s a growing reality for thousands of Americans every year. Whether it’s stretching your retirement dollars further, seeking a better quality of life, or simply chasing adventure, more U.S. retirees are choosing to live their golden years in foreign countries. But one of the most common (and important) questions we hear is:

“What happens to your Social Security check if you move overseas?” Let’s get into the nitty-gritty, with expert-backed insights, examples, and a down-to-earth tone to help you confidently plan your international retirement.

Table of Contents

What Happens to Your Social Security Check?

Retiring overseas with Social Security benefits is not only possible—it can be an excellent way to enjoy more freedom, culture, and affordability. But it’s not something to leap into without preparation. Take the time to:

- Understand eligibility rules

- Choose a SSA-approved country

- Set up your finances and health care

- File your taxes properly

- Stay in touch with the SSA

With proper planning, your Social Security check can follow you across borders and into the next exciting chapter of your life.

| Topic | Details |

|---|---|

| Can U.S. citizens receive Social Security abroad? | Yes, in over 100 countries. |

| Restricted countries | Benefits cannot be sent to Cuba and North Korea. |

| Non-citizen rules | Benefits may stop after 6 months abroad unless special agreements apply. |

| Direct Deposit available | In 80+ countries via the SSA’s International Direct Deposit (IDD) program. |

| Currency | Payments made in U.S. dollars, regardless of local currency. |

| Tax obligations | U.S. taxes still apply; some countries may tax benefits too. |

| Forms to watch | SSA-7162 questionnaire must be completed regularly. |

| Eligibility Tool | SSA Payments Abroad Tool |

Can U.S. Citizens Receive Social Security Checks While Living Abroad?

Yes. If you’re a U.S. citizen who has earned enough work credits—typically 40 credits (about 10 years of work)—you are eligible to receive Social Security retirement benefits, regardless of where you live in the world, with a few exceptions.

The Social Security Administration (SSA) allows payments in over 100 countries, including popular expat destinations such as Mexico, Portugal, Thailand, the Philippines, Panama, France, and more.

Once you’re outside the U.S. for 30 days, you’re considered a foreign resident by SSA standards. But your eligibility for payments doesn’t stop unless you move to a restricted country or fail to meet reporting requirements.

Countries Where Social Security Checks Are Restricted

While most countries allow you to receive your benefits, there are two countries where Social Security payments are completely prohibited:

- Cuba

- North Korea

If you move to either, your payments will be withheld. They won’t be lost, but the SSA will pause delivery until you move to an eligible country. Once you’re back in a permitted location, payments resume and any back pay will be disbursed.

Some other countries require special arrangements or have limited eligibility, such as:

- Vietnam

- Belarus

- Azerbaijan

- Georgia

In these countries, the SSA may only send payments if specific conditions are met, such as proof of identity, regular in-person interviews, or working through U.S. embassies.

What If You’re Not a U.S. Citizen: What Happens to Your Social Security Check

This is where things get a little more complex.

If you’re a non-U.S. citizen (e.g., a green card holder or former U.S. worker), the SSA may stop sending your payments after you’ve been outside the United States for six full calendar months unless:

- You return to the U.S. and stay for at least 30 consecutive days.

- You’re from a country that has a Social Security Totalization Agreement with the U.S.

A Totalization Agreement is an international treaty designed to coordinate Social Security coverage and benefits for people who work in both the U.S. and a foreign country.

Countries with totalization agreements include:

- Canada

- United Kingdom

- Germany

- Australia

- Japan

- South Korea

- Italy

These agreements may allow you to receive benefits longer than 6 months abroad, even if you’re not a U.S. citizen.

How Are Social Security Benefits Paid Abroad?

Social Security benefits are paid in U.S. dollars, regardless of your new country’s currency. There are two ways to receive your payments:

1. Direct Deposit (Best Choice)

The SSA offers International Direct Deposit (IDD) in over 80 countries. Your payment is deposited directly into a foreign or U.S. bank account, typically within a few days of your benefit date.

Direct deposit is:

- Fast

- Secure

- Less vulnerable to delays or theft

2. Paper Checks

Paper checks are still an option, but discouraged. They’re often delayed, especially in countries with unreliable mail service. In some places, checks might never arrive—or they can be lost or stolen.

Many embassies are phasing out services related to paper check cashing, so direct deposit is highly recommended.

The Role of SSA Questionnaires (Don’t Ignore Them!)

If you live outside the U.S., the SSA may send you Form SSA-7162, a questionnaire designed to confirm you’re:

- Still alive

- Still eligible for benefits

- Not in violation of residency or legal rules

If you don’t respond to this form within 60 days, your benefits may be suspended until the form is returned.

You might also be required to report:

- Changes in marital status

- Changes in address or bank account

- Death of a spouse or dependent

- Employment status if under full retirement age

It’s your responsibility to stay in touch with the SSA.

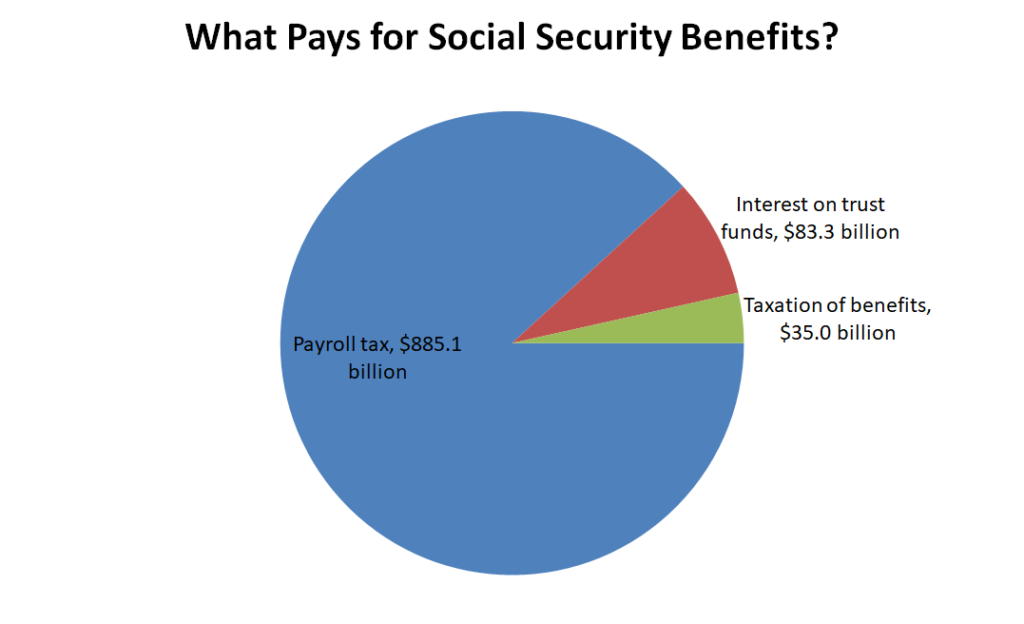

Do You Still Have to Pay Taxes on Your Social Security?

Yes. Even if you live abroad, the IRS expects you to file U.S. taxes and report all worldwide income, including Social Security benefits.

- If Social Security is your only income, you might not owe tax.

- If you have other income (like a pension, rental income, investments), then up to 85% of your Social Security benefit could be taxable.

Some countries may also tax your U.S. benefits, unless a tax treaty exists between the U.S. and your new country of residence.

Examples of countries with tax treaties:

- Germany

- Canada

- U.K.

- Ireland

- Sweden

Real-Life Case Study: Retiring in Portugal

Tom and Susan, a retired couple from Michigan, moved to Portugal in 2021. Tom receives $2,100/month in Social Security benefits. Here’s how they made it work:

- Signed up for International Direct Deposit through Novo Banco, a Portuguese bank.

- Hired a cross-border tax advisor to help file IRS taxes and Portuguese tax forms.

- Use Medicare Part A for emergencies when visiting the U.S. but purchased global expat insurance in Europe.

So far, they report zero issues receiving payments, and their cost of living dropped by over 30% compared to Michigan.

Comparison Table: Top Expat Retirement Countries

| Country | SSA Payment Allowed? | Direct Deposit? | Cost of Living | Tax Treaty? | Health Coverage |

|---|---|---|---|---|---|

| Mexico | Yes | Yes | Low | Yes | Public + private available |

| Portugal | Yes | Yes | Moderate | Yes | Public (if resident) + private |

| Thailand | Yes | Yes | Low | No | Private only |

| Costa Rica | Yes | Yes | Low | No | Public for residents |

| Philippines | Yes | Yes | Very Low | No | Private options |

| Spain | Yes | Yes | Moderate | Yes | Public if resident |

| Panama | Yes | Yes | Low | Yes | Private + expat-friendly |

Before You Go: Essential Pre-Move Checklist

- Check SSA payment eligibility for your chosen country.

- Enroll in direct deposit (via local or U.S. bank).

- Notify SSA of your new address, marital status, or dependent changes.

- Consult a tax advisor about your U.S. and foreign tax obligations.

- Purchase international health insurance (Medicare does not cover you abroad).

- Make estate planning updates to reflect your international residence.

- Get legal residency or long-term visa in your new country.

- Stay in touch with the nearest U.S. embassy or consulate.

Student Loan Wage Garnishment Returns in 2026 — Who Could Be Affected

Social Security Payments Could Reach $5,430 a Month in 2026 — Here’s How

How the 2.8% COLA Adjustment Will Reshape Social Security Payments in 2026