IRS Refunds Rise More Than 10%: IRS refunds rise more than 10% early in filing season, and that trend is shaping conversations everywhere from kitchen tables to corporate boardrooms. Early data from the Internal Revenue Service shows Americans are receiving noticeably larger refunds, triggering both excitement and questions about what this means for taxpayers and the broader economy. While a bigger refund can feel like a welcome bonus, understanding why this seasonal shift is happening—and what you should do about it—can help you make smarter financial decisions. This year’s early filing season looks very different compared to the last few years. The tax landscape has shifted due to updated federal laws, inflation adjustments, economic pressures, and changes in household financial behavior. To many people, a larger refund feels like a “win,” but experts caution that the numbers tell a deeper story. Whether you’re a W-2 employee, self-employed, managing a family budget, or running a small business, this expanded analysis will help you interpret the refund spike with clarity and confidence.

Table of Contents

IRS Refunds Rise More Than 10%

The rise in IRS refunds early in the filing season shows how tax laws, inflation, and withholding patterns combine to influence the financial lives of millions of Americans. Larger refunds may relieve some of the economic pressure households have faced in recent years, but they also highlight the importance of understanding how tax systems work. By staying informed, planning ahead, and using official IRS tools, taxpayers can take control of their financial futures and make the most of refund season.

| Feature | Details |

|---|---|

| Average Refund Increase | Refunds up 10–11% early in the season |

| Average Refund Amount | Approximately $2,290 per filer |

| Main Drivers | New tax law adjustments, inflation indexing, over-withholding |

| Delayed Refund Groups | EITC and ACTC claimants due to PATH Act |

| Economic Influence | Refunds helping offset household debt and inflation costs |

| Official IRS Reference | https://www.irs.gov |

| Expert Insight | Early averages often shift as more complex returns are filed |

Why IRS Refunds Rise More Than 10% This Year?

The 10%+ jump in refund averages is not random. It reflects a combination of policy changes, inflation adjustments, employer withholding patterns, and taxpayer behavior. To better understand why refunds appear larger, we must break down the elements that directly affect your tax bill.

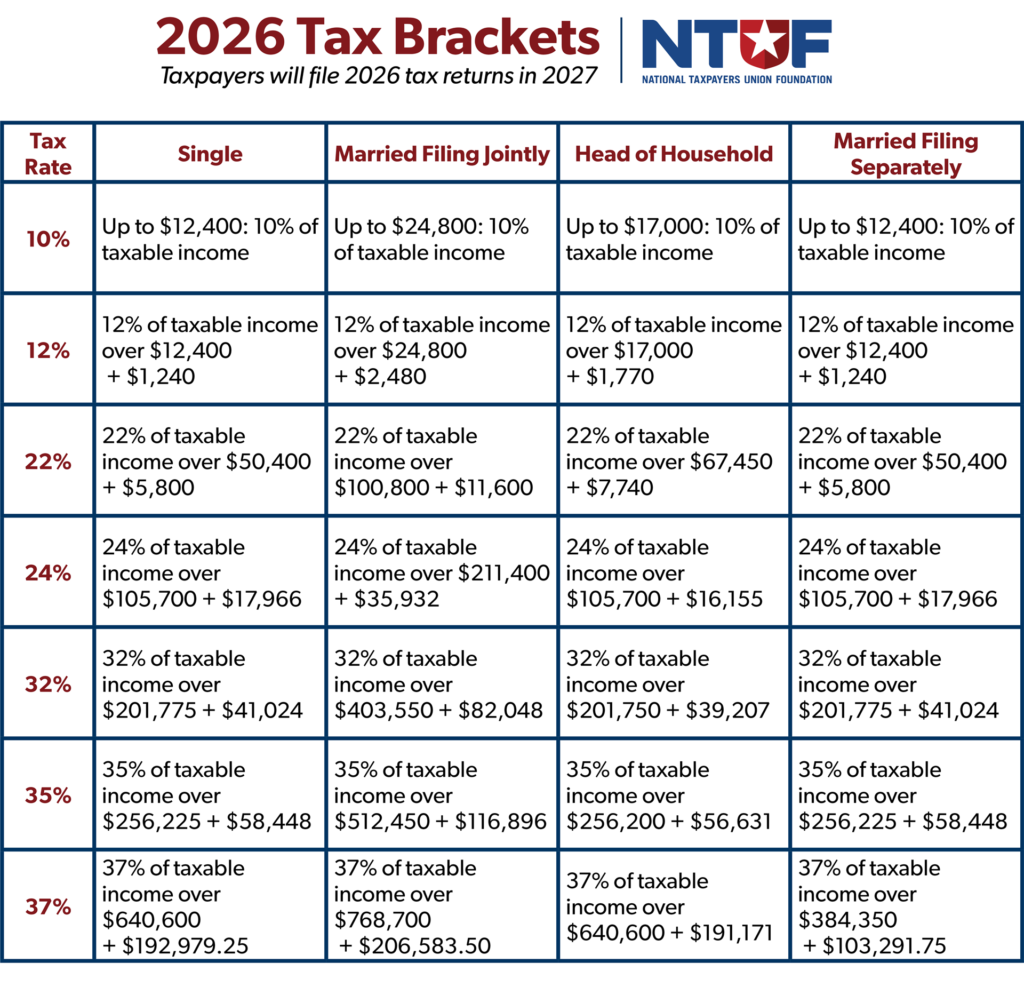

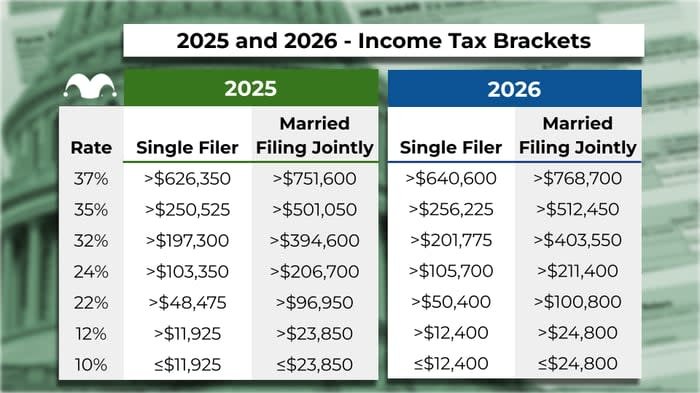

One of the biggest contributors is the set of adjustments introduced at the federal level, including expansions in the standard deduction, wider tax brackets, and inflation-responsive thresholds for certain credits and deductions. Many of these shifts were designed to prevent taxpayers from being pushed into higher tax brackets solely because inflation raised wages. Simply put, even though income increased for many workers, the tax owed did not increase at the same pace.

Another major driver is employer withholding practices. Many employers did not update federal withholding tables until later in the year, resulting in workers unknowingly paying more taxes than required during each paycheck cycle. When tax filing season arrives, the IRS reconciles these overpayments, which leads to larger refunds.

The Impact of IRS Refunds Rise More Than 10% on Refund Totals

Inflation has played a surprising role in refund sizes. While inflation has increased the cost of groceries, fuel, medical care, and housing, it has also led to higher IRS inflation adjustments. For example, taxpayers saw noticeable increases in the standard deduction and tax bracket thresholds for the 2025 tax year. This widening of the tax brackets means taxpayers can earn more before hitting higher tax rates.

Imagine you earned $60,000 in 2024 and $63,000 in 2025. Normally, an income increase might push more of your earnings into a higher bracket. But because inflation pushed up bracket limits, your income may still fall within the same bracket, resulting in a lower tax liability than expected. And if your employer continued withholding based on older tables, you effectively paid more tax throughout the year than required, generating a larger refund.

Inflation also affects deductions and credits. Certain tax credits—such as the Child Tax Credit, Saver’s Credit, or Earned Income Tax Credit—saw expanded thresholds that allowed more taxpayers to qualify or claim higher amounts. These small boosts can add up to significant differences across millions of filings.

Early Filers Tend to Receive Larger Refunds

Tax filing season is like a wave. The earliest wave of filers typically consists of wage earners, families qualifying for refundable credits, and those eager to receive their refunds quickly. Historically, early filers tend to end up with larger refunds. This is because:

- Their financial situations are often simpler and involve straightforward W-2 income.

- They frequently over-withhold out of caution.

- They may qualify for refundable credits or deductions that amplify refund totals.

- They are less likely to owe self-employment tax or have complex investment income.

As more complex returns from business owners, high-income earners, and investors arrive later in the season, the overall average refund often shifts downward. This is why IRS early-season data, while accurate, is not the final story.

What the Latest IRS Data Tells Us?

The IRS reports that while fewer refunds have been issued compared to this time last year, the average refund amount is significantly higher. Electronic filing continues to dominate the landscape, with more than 90% of taxpayers using digital tools or authorized providers.

However, taxpayers claiming the Earned Income Tax Credit (EITC) or Additional Child Tax Credit (ACTC) will not receive refunds before mid-February due to the Protecting Americans from Tax Hikes (PATH) Act. This law is designed to prevent improper refund payments and identity fraud by requiring additional verification steps for these credits.

Because these refunds often involve larger amounts, the national average refund may rise as the IRS begins releasing these payments.

How IRS Refunds Rise More Than 10% Affect American Households?

With consumer credit card debt reaching record highs according to Federal Reserve data, many families are planning to use their tax refunds to manage overdue bills, reduce credit card balances, or catch up on loan payments. A refund of even a few hundred dollars can provide breathing room in a tight budget.

In surveys conducted by financial institutions, nearly half of respondents say they view their tax refund as a form of forced savings. About a third of taxpayers rely on their refund as part of their financial planning strategy. While financial professionals often encourage taxpayers to adjust their withholding so they receive more in their regular paychecks rather than a large lump sum at tax time, many everyday Americans continue to prefer the psychological comfort of a sizable refund.

A Practical Guide to Getting Your Refund Faster

Filing accurately and strategically is the key to ensuring a smooth refund experience. Even small errors can trigger delays.

Electronic filing remains the fastest method for processing your return. Paper returns, while still permitted, can take anywhere from six to twelve weeks or longer depending on IRS workload. Choosing direct deposit is equally important because it reduces the risk of check theft and speeds up access to funds.

Before submitting your return, review your Social Security numbers, names, and addresses carefully. A single mismatch between the IRS database and your return can place your refund on hold. This is especially common after marriage, divorce, or legal name changes.

Why Refund Delays Happen?

Refund delays are not always caused by taxpayer error. Sometimes the IRS requires additional verification due to identity theft prevention, mismatched employer-reported income, or inconsistencies between federal documents and your return. Taxpayers claiming multiple dependents or refundable credits often see slightly longer processing times.

Pro Strategies for Maximizing Next Year’s Refund

Tax planning is a year-round effort. To optimize your results, start by adjusting your W-4 form. Whether you prefer a larger paycheck or a larger refund, the IRS Tax Withholding Estimator can help you find the right balance.

If you are self-employed or earn income from gig work, keep meticulous records of deductible expenses. Apps and software tools can streamline your bookkeeping, ensuring you don’t miss out on legitimate deductions.

Contributing to tax-advantaged accounts such as 401(k)s, IRAs, HSAs, and FSAs can also reduce your taxable income and boost your refund. Even small increases in contributions throughout the year can lead to noticeable tax savings.

Common Mistakes That Taxpayers Should Avoid

Taxpayers often delay their refunds unintentionally by filing too early, forgetting side-gig income, overlooking tax forms, or falling for scams. Always make sure to gather all W-2s, 1099s, and other statements before filing. Failing to include a 1099 from gig apps such as Uber or DoorDash can lead the IRS to flag your return for review.

Scammers frequently target taxpayers through text messages, emails, and phone calls pretending to be IRS agents. The IRS never demands payment through gift cards or digital wallets.

Economic Perspective: What This Trend Means for the Country

Higher refunds can temporarily stimulate the economy through increased consumer spending. Many businesses observe a spike in sales during tax season as families use refunds to purchase necessities, catch up on repairs, or make long-delayed purchases.

At the same time, because a large refund is simply an overpayment returned to the taxpayer, it can also signal inefficiencies in withholding practices. Tax professionals sometimes encourage individuals to fine-tune their withholding to avoid giving the government an interest-free loan.

From a broader economic standpoint, the increase in refunds highlights the tension between rising costs of everyday living and the financial relief taxpayers feel during refund season. As more taxpayers apply refunds toward debt reduction, the nation’s household financial stability may improve modestly.

IRS Confirms $1776 Tax-Free Payments for 1.5 million Americans

Student Loan Wage Garnishment Returns in 2026 — Who Could Be Affected

New IRS Rule Targets PayPal, Venmo, and Cash App Tax Reporting in 2026