The Alaska Permanent Fund Dividend will provide roughly $1,000 to eligible residents in 2026, continuing a unique state program that shares oil-generated investment earnings directly with citizens. Officials say payments will be distributed in scheduled batches after applications close in spring, but only residents meeting strict legal and residency criteria will qualify.

Table of Contents

$1,000 Payout As 2026 Dividend Decision Lands

| Key Fact | Detail |

|---|---|

| Program start | First payment issued in 1982 |

| Funding | Investment earnings from oil revenue savings |

| Estimated payment | About $1,000 in 2026 |

| Application period | January 1 – March 31 annually |

What the Alaska Permanent Fund Dividend Is

The Alaska Permanent Fund Dividend (PFD) is not a relief check, stimulus program, or welfare benefit. Instead, it is a state-run citizen dividend financed by returns on investments made from oil revenue savings.

In 1976, Alaska voters approved a constitutional amendment creating the Alaska Permanent Fund. Lawmakers wanted to avoid repeating the boom-and-bust cycles experienced by resource-dependent economies. Rather than spending all oil income immediately, the state invested a portion for future generations.

The fund’s principal cannot be spent. Only earnings may be used, and part of those earnings are distributed to residents annually as the dividend.

The state-owned investment portfolio now holds tens of billions of dollars and invests globally across financial markets, including equities, bonds, infrastructure, and real estate.

Economists often describe the program as a “resource ownership model,” where citizens collectively own part of natural resource wealth.

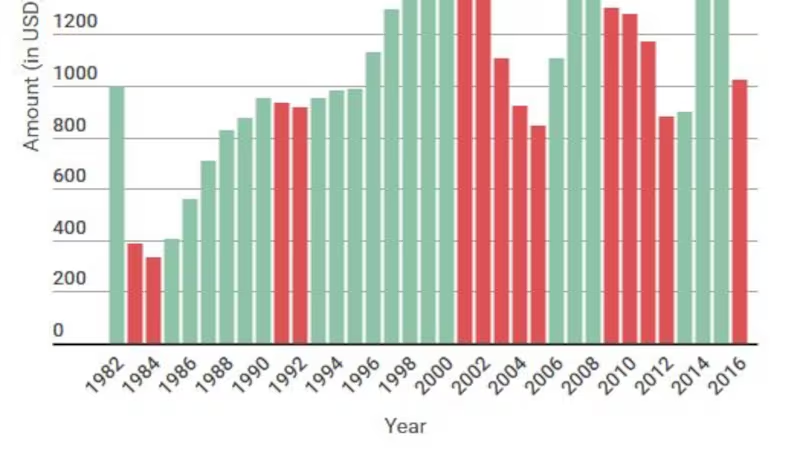

How the Payment Amount Is Calculated

The annual payment is determined using a formula based on the fund’s average earnings over several years. This method prevents dramatic swings caused by short-term market volatility.

State officials calculate the dividend from realized investment returns rather than raw oil revenue. As a result, global stock markets, interest rates, and inflation all influence the payout.

Recent payment examples:

- 2015: about $2,072

- 2020: about $992

- 2022: over $3,000 due partly to high energy revenue

- 2026: expected near $1,000

Because the dividend depends on investment performance, strong financial markets can increase payments, while downturns can reduce them.

Distribution Process

Payments are not issued all at once. Instead, the state sends funds in several scheduled groups.

Residents who apply early and choose direct deposit generally receive funds first. Paper checks typically arrive later.

Officials say the staggered system helps prevent administrative overload and reduces fraud risk.

Eligibility Criteria for $1,000 Payout As 2026 Dividend Decision Lands

Residency Requirements

Applicants must:

- Live in Alaska for the entire qualifying year

- Intend to remain permanently

- Avoid claiming residency elsewhere

Simply owning property or having a mailing address in Alaska does not qualify a person.

Physical Presence

Residents must spend most of the year in the state. Limited absences are allowed for:

- military service

- higher education

- medical treatment

Applicants must demonstrate continued ties to Alaska.

Legal Restrictions

Disqualification may occur if the applicant:

- was incarcerated for certain crimes

- was convicted of particular felonies

- violated absence rules

Each application undergoes verification by state authorities.

Who Receives the Money

All eligible residents receive equal payments, including children. Parents apply on behalf of minors.

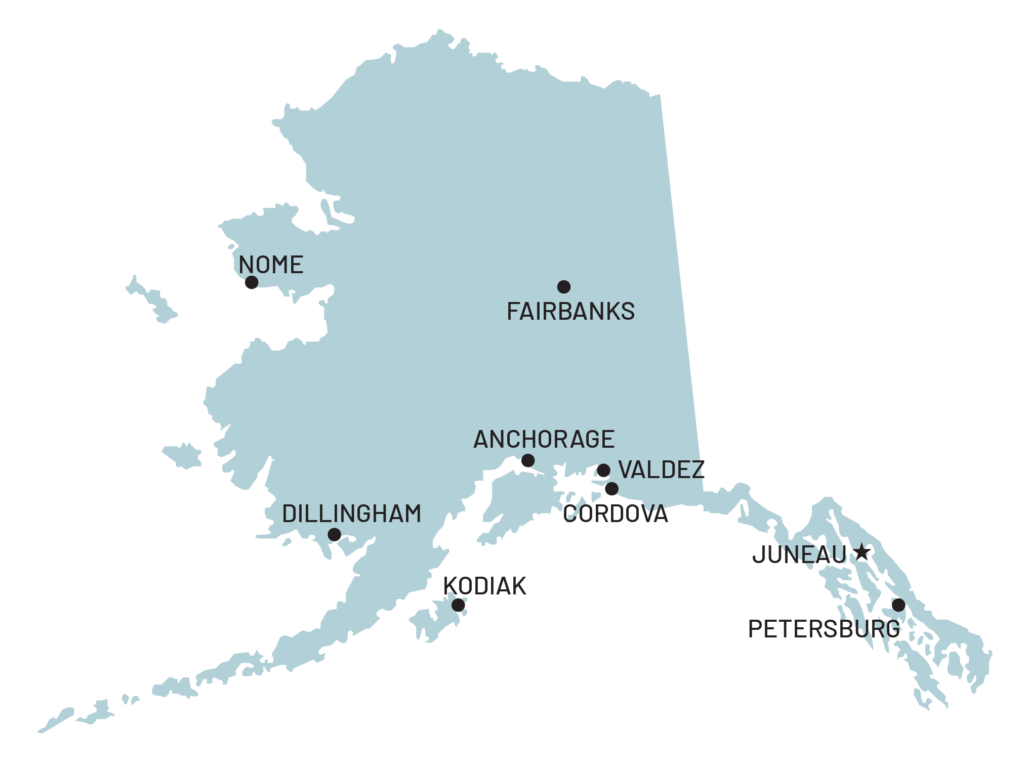

Because Alaska’s population is relatively small — about 730,000 people — the dividend reaches a large percentage of households.

For many rural residents, the dividend represents a meaningful portion of annual income.

How Residents Use the Dividend

Studies by the University of Alaska’s Institute of Social and Economic Research show most recipients spend the money on essential needs.

Common uses include:

- heating fuel during winter

- airfare between remote villages

- groceries

- winter clothing

- debt payments

In remote areas where goods must be flown in, the payment helps households manage high living costs.

Retail sales across Alaska often rise significantly during the weeks after payments are issued.

Effect on Poverty and Employment

Researchers have examined whether unconditional cash payments discourage work.

A study by the National Bureau of Economic Research found no significant decline in overall employment following dividend payments. Instead, part-time work slightly increased as consumer demand rose.

Some analysts also found reductions in poverty, particularly among rural and Indigenous populations.

Economist Scott Goldsmith, who has studied the program for decades, noted the dividend “acts like an automatic economic stabilizer during downturns.”

Political Debate in Alaska

Although widely popular with voters, the dividend is one of Alaska’s most contested political issues.

The state relies heavily on oil revenue but faces budget pressures due to declining production and rising costs.

Lawmakers must balance two competing priorities:

- Paying larger dividends to residents

- Funding government services such as schools, roads, and healthcare

Some officials advocate increasing payments, arguing natural resources belong equally to citizens. Others argue larger payments reduce funding for public services.

Each year, the Alaska Legislature debates how much of the fund’s earnings should go to dividends.

Taxation and Federal Rules

The dividend is not taxed by Alaska because the state has no income tax.

However, the U.S. Internal Revenue Service treats it as taxable income under federal law. Recipients must report the payment when filing federal taxes.

This requirement often surprises first-time recipients and parents applying for children.

Why the Program Is Globally Important

Policy experts around the world study the Alaska Permanent Fund Dividend because it resembles a real-world version of a universal basic income funded by public assets.

Unlike pilot programs, Alaska’s system has operated continuously for over four decades.

Researchers from universities and economic think tanks frequently reference it when discussing whether governments can distribute resource wealth directly to citizens.

Countries rich in natural resources — including Norway and some Gulf states — have examined similar approaches, though none distribute payments exactly like Alaska.

Fraud Prevention and Verification

State officials conduct audits each year to prevent fraudulent applications.

Applicants must provide identifying documentation and residency evidence. Authorities also cross-check records with other government databases.

Fraud cases are prosecuted, and individuals found guilty may face fines, repayment requirements, and future disqualification.

Application Deadline

Residents must apply annually between January 1 and March 31.

Late applications are rarely accepted except under limited circumstances such as severe medical emergencies.

FAQs About $1,000 Payout As 2026 Dividend Decision Lands

Is it a stimulus check?

No. It is a recurring dividend funded by investment earnings.

Do children qualify?

Yes. Guardians apply for minors.

Can former residents claim it?

No. You must live in Alaska for the entire qualifying year.

Is it guaranteed forever?

The program continues as long as the fund produces earnings and lawmakers authorize payments.

Outlook

Alaska officials say the dividend remains financially sustainable but dependent on investment returns and state budget decisions. Future payments may rise or fall depending on global markets and oil revenue trends.

State analysts expect the program to remain central to Alaska’s economy and politics, with annual debates likely to continue over how much should go directly to residents.