In February 2026, widespread attention has focused on so-called federal cash deposits amid the ongoing tax refund season. According to the Internal Revenue Service (IRS), these deposits reflect routine tax refunds from 2025 filings, not a newly authorized federal stimulus, with timing and amounts varying by filing method and refundable credits claimed.

Table of Contents

February 2026 Federal Cash

| Key Fact | Detail / Statistic |

|---|---|

| Refund Timing | Most e-filed returns with direct deposit are processed within ~21 days of IRS acceptance |

| Average Refund | Early 2026 projections: $2,600+ for typical direct deposit filers |

| Refund Delays | Refundable credits such as EITC or ACTC may delay deposits until mid-February or early March |

| Misconceptions | No new $2,000 federal payment authorized; online claims are inaccurate |

February 2026 sees routine IRS refunds being processed, with amounts often misinterpreted as new federal cash payments. Early electronic filers receive faster deposits, while refundable credits and verification requirements can delay others. Taxpayers are advised to monitor official IRS channels, understand refund mechanisms, and exercise caution against misinformation.

Understanding February Refunds

Each February, attention turns to federal financial flows as the Internal Revenue Service (IRS) processes millions of tax returns. In 2026, social media and online forums have highlighted claims of large “federal cash deposits” occurring in early February. Investigations reveal these are primarily standard tax refunds, not newly authorized federal payments.

The IRS began accepting 2025 tax returns — filed in 2026 — on January 26, 2026. Refunds for early filers who use direct deposit often appear within about three weeks, assuming accurate submissions. Refundable credits, errors, or audits can delay this timeline.

“This is a routine process, not an extraordinary federal payout,” a Treasury official said in a standard press briefing on February 5.

Historical Context: Why February Rumors Persist

Confusion stems from prior federal programs. In 2020 and 2021, U.S. households received stimulus payments under laws such as:

- CARES Act (March 2020) – $1,200 per adult and $500 per child.

- Consolidated Appropriations Act (Dec 2020) – $600 payments.

- American Rescue Plan (March 2021) – $1,400 per person.

These payments were direct deposits, similar to routine tax refunds, leading many to assume any February deposit might be a stimulus. Unlike those programs, no new legislation authorizing a federal cash transfer in February 2026 has passed Congress.

How Refund Amounts Are Determined

Refunds vary based on:

- Income and tax withholdings: Overpaid taxes are returned.

- Filing status: Single, married, head-of-household.

- Refundable tax credits: EITC, Child Tax Credit, education credits.

- Banking information: Correct routing and account numbers ensure faster processing.

For example, a single filer with moderate earnings may receive a refund around $1,500–$2,000, aligning with average deposit amounts cited online. Larger refunds typically reflect refundable credits, not extra federal payouts.

Step-by-Step Guide: How Refunds Are Processed

- Filing Submission

- Returns submitted electronically are generally faster. Paper returns may take 6–8 weeks.

- IRS Acceptance

- IRS acknowledges the return within 24 hours for e-filed submissions.

- Validation Checks

- Information, such as Social Security numbers and bank details, are verified.

- Credit Review

- Refundable credits (EITC, ACTC) undergo additional verification before release.

- Deposit or Check Issuance

- Approved refunds are deposited directly into the taxpayer’s bank account or issued as a mailed check.

Tip: Use the IRS “Where’s My Refund?” tool to track your status and avoid delays.

Timeline Estimates for Early 2026 Filers

- January–early February: Early e-file returns with direct deposit typically processed within 21 days.

- Mid-February to early March: Refunds claiming EITC or ACTC begin disbursement.

- Late March–April: Paper returns and returns requiring additional review processed.

Delays may result from missing banking info, identity verification, or IRS audits.

Common Misunderstandings

Social media posts often mislabel average refund amounts as extra federal cash. Rumors of a $2,000 automatic deposit in February 2026 are unsubstantiated. Experts emphasize:

“These deposits are refunds of taxes already paid, not new stimulus funds. Misinterpretation is common because February historically sees large refunds from early filers,” said Dr. Elaine Morrison, senior tax policy analyst.

Refunds and Household Cash Flow

Tax refunds are an important source of disposable income for many Americans. Economists note that timing and size of refunds affect consumer spending patterns:

- Families often use refunds to pay off debt or fund household expenses.

- Early refunds can provide temporary liquidity in post-holiday months.

- Refunds delayed by verification processes may push household budgets into March.

“Even though these are not new federal funds, how they arrive can materially impact family finances,” said a certified public accountant in Washington, D.C.

Safeguarding Against Scams

With widespread online discussions about February deposits, IRS officials warn taxpayers to avoid scams:

- The IRS does not initiate contact by phone, email, or text for payments.

- Requests for payment or personal information are always fraudulent.

- Use official IRS channels for all refund-related inquiries.

Special Considerations: Refundable Credits

Refundable credits are among the most common causes of delayed refunds:

- Earned Income Tax Credit (EITC)

- Designed to support low- to moderate-income workers.

- Triggers additional verification before refunds are released.

- Additional Child Tax Credit (ACTC)

- Provides partial refund even if no federal tax is owed.

- Delays in disbursement ensure correct credit calculation.

Understanding these credits helps explain why some taxpayers receive refunds later than others, despite filing early.

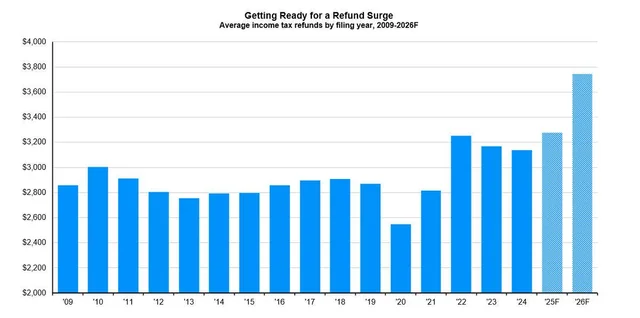

Comparing Refund Averages Over the Years

| Year | Average Refund (USD) | Notes |

|---|---|---|

| 2023 | 2,350 | EITC processing delayed refunds for early filers |

| 2024 | 2,475 | Strong early filing season |

| 2025 | 2,500 | Inflation adjustments slightly increased refunds |

| 2026 (projected) | 2,600+ | Early indications for direct deposit filers |

Forward-Looking Perspective

As 2026 filing season continues:

- IRS encourages early, accurate e-filing.

- Taxpayers should monitor direct deposit status and update banking information promptly.

- Understanding refundable credit timelines prevents unnecessary worry over delays.

No new universal federal cash payments are expected, but timely refunds continue to be a critical financial event for millions of households.

FAQs About February 2026 Federal Cash

Q1: Is the $2,000 federal cash deposit real?

A1: No, there is no authorized federal payment of this amount in February 2026. The amounts reflect standard tax refunds.

Q2: How can I track my refund?

A2: Use the IRS “Where’s My Refund?” online tool, updated daily once a return is accepted.

Q3: What delays refunds?

A3: Refundable credits like EITC and ACTC, incorrect bank info, or IRS verification audits.

Q4: Can I still get a paper check?

A4: Yes, but the IRS is encouraging direct deposit for faster processing; incorrect or missing banking info may delay checks.