Viral posts and emails about February 2026 Stimulus Talk payments have surged across the United States, claiming the government has begun issuing $2,000 direct deposits. Federal agencies say no nationwide stimulus program exists. Instead, tax refund deposits, political proposals, and online scams are being widely misinterpreted as new economic relief.

Table of Contents

February 2026 Stimulus

| Key Fact | Detail |

|---|---|

| No new stimulus checks | No federal law authorizes a 2026 nationwide payment |

| Deposits appearing now | Most payments are tax refunds |

| Tariff dividend | A proposal, not enacted legislation |

What the February 2026 Stimulus Talk Claims Are Saying

Across social media platforms, users have posted screenshots of bank deposits labeled “US TREASURY” or “IRS TREAS 310.” Many interpret the payments as a newly approved federal stimulus.

The Internal Revenue Service (IRS) has stated clearly that there is no new Economic Impact Payment program in 2026. The last national stimulus checks were authorized during the COVID-19 emergency.

An IRS written advisory warned taxpayers to rely on official correspondence rather than viral claims. The agency emphasized that legitimate payments are always traceable through tax filings or benefit programs.

Consumer protection groups say the confusion is understandable. Millions of taxpayers receive funds simultaneously during filing season, and the deposits appear without warning.

Why Americans Are Seeing Direct Deposits Now

Tax Refund Season

The IRS opened the 2026 filing season in late January. Millions filed within days using electronic systems.

Refunds typically arrive within 21 days after return acceptance. That places the first major payment wave in mid-February every year.

Financial planners note refunds can be large because employers withhold estimated taxes throughout the year.

“People often view a refund as new income,” said a U.S. tax preparer interviewed by national media. “But it’s actually money they already earned and overpaid.”

Historical Context: Previous U.S. Stimulus Payments

To understand the February 2026 Stimulus Talk, it helps to examine earlier relief programs.

Pandemic-Era Payments

Between 2020 and 2021, the U.S. government issued three major stimulus rounds:

- March 2020: CARES Act payments

- December 2020: Relief package payments

- March 2021: American Rescue Plan payments

Those checks ranged from $600 to $1,400 per person and reached most households.

Economists say the unprecedented scale created lasting public expectations that similar payments could occur again during financial stress.

The “Tariff Dividend” Proposal

One central claim in February 2026 Stimulus Talk refers to a proposed “tariff dividend,” which would redistribute tariff revenue to citizens.

However, policy experts stress it remains hypothetical.

For payments to occur:

- Congress must pass legislation

- The Treasury must allocate funds

- The IRS must build distribution infrastructure

Trade economists also note tariffs are not a stable funding source.

“Tariffs fluctuate with trade volume and often reduce imports,” explained a university trade policy researcher. “That makes predictable annual checks difficult to sustain.”

Economic Reality Behind Tariffs

Tariffs are taxes on imported goods paid by importers. Most economists agree businesses often pass the cost to consumers through higher prices.

Therefore, a tariff-funded dividend could partly offset costs that consumers already indirectly paid.

This economic debate remains ongoing among policymakers.

How Misinformation Spread

Experts studying online communication say the February 2026 Stimulus Talk grew rapidly due to algorithmic amplification.

Three factors contributed:

• Similar bank deposit descriptions

• Past stimulus memories

• Organized scam campaigns

Fraud analysts say scammers send text messages directing recipients to fake IRS websites.

The IRS warns it never requests financial information via unsolicited messages.

Real-World Scam Examples

Consumer advocacy organizations report several common fraud patterns:

- Fake refund verification portals

- “Claim your stimulus now” links

- Calls requesting Social Security numbers

In one reported case, victims entered banking details into a fraudulent website and lost savings within hours.

The Federal Trade Commission has repeatedly warned that financial rumors often accompany identity-theft attempts.

Tax Refunds vs. Stimulus Payments

| Tax Refund | Stimulus Payment |

|---|---|

| Return of overpaid taxes | Government benefit |

| Based on personal filing | Based on federal law |

| Occurs annually | Rare emergency measure |

Electronic deposits now look identical, which increases misunderstanding.

Broader Economic Effects

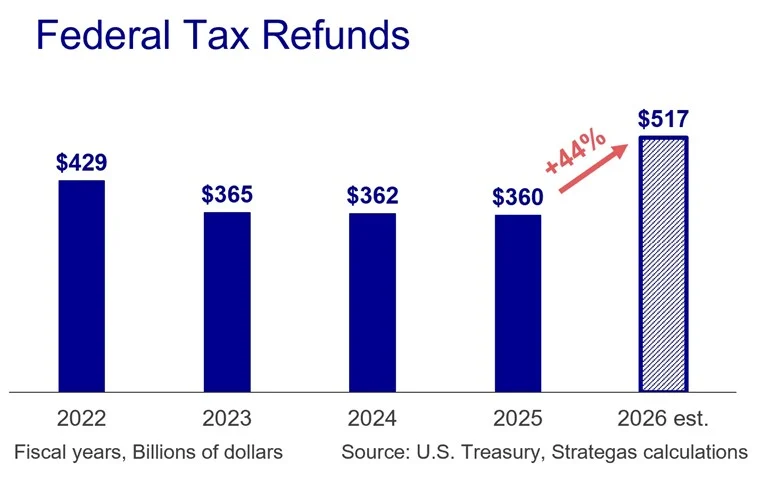

Economists track refund season because it influences consumer spending.

Retail analysts report that tax refunds historically boost purchases of:

• electronics

• household appliances

• debt repayments

However, experts say refunds are not true economic stimulus because the money already belonged to taxpayers.

International Comparison

Other countries also issued pandemic relief, but few continue direct payments.

For example:

- Canada used temporary emergency benefits

- The United Kingdom relied on wage subsidies

- Japan issued a one-time universal payment

Most governments shifted back to targeted aid rather than universal checks.

Why the Rumor Persists

Behavioral economists say expectations shape interpretation.

“When people expect relief, they interpret ordinary financial activity as assistance,” said a university behavioral finance researcher.

Additionally, reposted news headlines from previous years frequently resurface each tax season.

Official Guidance

Authorities advise taxpayers to verify payments using official tools.

Steps:

• Check IRS refund tracker

• Review filed return

• Avoid clicking unsolicited links

Financial Literacy Angle

Financial counselors say the episode highlights a broader issue: misunderstanding of taxation.

Many Americans believe refunds are government benefits rather than withheld wages returned.

Understanding this difference can improve budgeting decisions and reduce vulnerability to scams.

Policy Debate Going Forward

Some policymakers support direct payments during economic slowdowns. Others prefer targeted programs such as child tax credits or unemployment assistance.

Economists remain divided. Supporters say direct payments stimulate spending quickly. Critics argue they increase deficits and inflation.

For now, no legislation authorizing payments exists.

What Happens Next

No nationwide relief program is currently scheduled. Any future payment would require formal legislation and official announcement.

An IRS official advised taxpayers to “verify, not speculate,” emphasizing that legitimate payments always come with documented records.

FAQs About February 2026 Stimulus

Are new stimulus checks coming in 2026?

No federal law authorizes one.

What is the tariff dividend?

A policy proposal, not implemented.

Why did I get money?

Most likely a tax refund.

How do I confirm?

Use official IRS tools.