Confusion over February 2026 Stimulus and IRS Payments has spread widely online as the United States tax filing season begins. Viral posts claim Americans are receiving new federal checks worth $1,400 or $2,000, but federal agencies say no nationwide stimulus payment has been authorized. Most deposits arriving in February are routine tax refunds and existing tax credits, according to the Internal Revenue Service (IRS).

Table of Contents

February 2026 Stimulus and IRS Payments

| Key Fact | Detail |

|---|---|

| No new federal stimulus | Congress has not approved a 2026 stimulus law |

| Deposits in February | Mostly tax refunds from 2025 tax returns |

| Pandemic payments | Final claim deadline passed April 15, 2025 |

Why the February 2026 Stimulus and IRS Payments Rumors Started

The confusion began shortly after the IRS opened the 2026 filing season in late January. Millions of taxpayers started receiving direct deposits within weeks.

“These are refunds, not stimulus checks,” the Internal Revenue Service said in its filing season guidance to taxpayers. The agency noted refunds typically arrive within 21 days after electronic filing with direct deposit.

Financial experts say the timing created a perfect environment for misinformation.

“People see a government payment in their account and assume it’s new relief,” said Mark Luscombe, principal federal tax analyst at Wolters Kluwer Tax & Accounting, in public commentary to U.S. media. “In most cases, it’s simply their own withheld tax money coming back.”

Social Media Amplification

Posts on TikTok, YouTube, and Facebook claimed:

- a universal $2,000 payment

- a reissued pandemic relief check

- special IRS registration programs

No federal program matching those descriptions exists.

What Payments Are Actually Being Sent

Tax Refunds

The primary source of February deposits is the annual refund process. According to the IRS, refunds are issued when workers have paid more tax through payroll withholding than they ultimately owed.

The average refund in recent filing seasons has exceeded $3,000, according to IRS historical filing statistics.

Earned Income Tax Credit and Child Tax Credit

Additional payments may come from tax credits, including:

- Earned Income Tax Credit (EITC)

- Child Tax Credit (CTC)

Congress expanded these credits during the COVID-19 pandemic, but they have since returned largely to their standard structure. They are delivered through tax refunds rather than separate stimulus payments.

The Pandemic Stimulus Checks: Important Background

The United States previously issued three nationwide stimulus payments during the COVID-19 emergency:

- March 2020 — CARES Act payments

- December 2020 — Consolidated Appropriations Act

- March 2021 — American Rescue Plan

Taxpayers who missed the final $1,400 payment could claim it through the Recovery Rebate Credit. However, the legal deadline to do so was April 15, 2025, according to IRS regulations.

“The window to claim that payment has closed,” the IRS stated in public guidance. No mechanism exists to newly request it in 2026.

The $2,000 “Tariff Dividend” Proposal

Another driver of confusion is a political proposal sometimes referred to online as a tariff dividend. The idea suggests distributing revenue collected from import tariffs to U.S. households.

Policy analysts emphasize it remains a concept, not a law.

“Any payment would require congressional approval and a funding mechanism,” said Erica York, senior economist at the Tax Foundation, a Washington-based policy research group. “Neither has occurred.”

How Scams Are Targeting Taxpayers

Federal officials warn that rumors surrounding February 2026 Stimulus and IRS Payments have been used in phishing schemes.

Common scam tactics include:

- emails requesting Social Security numbers

- texts asking for banking information

- links claiming to “claim your payment”

The IRS states it never contacts taxpayers first by text or social media for payment collection or benefit enrollment.

How to Verify Legitimate IRS Payments

Taxpayers can confirm legitimate activity through the IRS online account system or mailed notices. Real federal payments always follow a public legal authorization and official announcement.

Key verification rules:

- Congress must pass a law

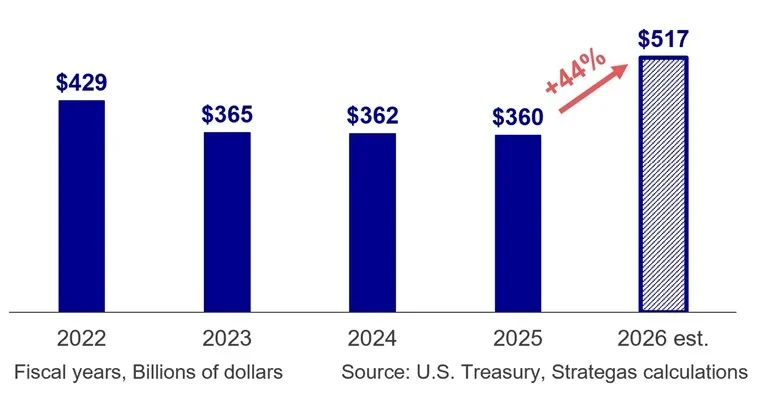

- Treasury must fund it

- IRS must formally announce it

If one of these steps is missing, experts say the payment is not a stimulus.

What to Expect Next

Refund processing will continue through April as filing volume increases. Tax professionals expect misinformation to persist throughout the filing season.

“The pattern repeats every year,” Luscombe said. “Refund season becomes stimulus rumor season.”

For now, federal officials say there is no new nationwide relief payment scheduled in 2026.

FAQs About February 2026 Stimulus and IRS Payments

Is there a new $1,400 or $2,000 stimulus check in February 2026?

No. Congress has not approved any new nationwide stimulus program.

Why did I receive a deposit from the IRS?

Most likely a tax refund or tax credit payment from your filed return.

Can I still claim the COVID stimulus payment?

No. The deadline passed in April 2025.

Does the IRS ask for information by text message?

No. The agency communicates primarily by official letters.