Four Key Student Loan Deadlines: If you’re a student loan borrower in the U.S., 2026 is shaping up to be one of the most important years in decades. There are four key student loan deadlines coming up, and they’re not just bureaucratic dates buried in the fine print. They’re serious milestones that could change how you pay back your loans, whether you’re eligible for forgiveness, and how much you’ll owe long term. This guide will walk you through each of these deadlines, breaking them down in a way that’s easy to follow and packed with real advice. Whether you’re just starting out in your career, planning to go back to school, or supporting your kids through college, the time to act is now.

Table of Contents

Four Key Student Loan Deadlines

These four deadlines aren’t just bureaucratic red tape—they’re your roadmap to potentially saving thousands of dollars in interest, qualifying for forgiveness, and avoiding repayment plans that don’t work for you. By consolidating, borrowing smartly, switching plans proactively, and monitoring legal decisions, you can stay ahead of the curve. Most importantly, don’t wait. Government processing delays are real. These changes are coming fast, and the borrowers who prepare now will benefit the most.

| Deadline | What It Means | Effective Date |

|---|---|---|

| Loan Consolidation Deadline | Consolidate FFEL, Perkins, or Parent PLUS loans into a Direct Loan to qualify for PSLF and SAVE plan | June 30, 2026 |

| Repayment Plan Overhaul | New loans issued after July 1, 2026 only qualify for Standard or RAP (no SAVE or PAYE) | July 1, 2026 |

| Income-Driven Repayment Transition | Must switch from old IDR plans like PAYE/ICR to new options or lose certain benefits | July 1, 2028 |

| Borrower Defense Court Ruling | Lawsuit could cancel loans and issue refunds for 200,000+ borrowers | February 10, 2026 |

The Big Picture: Why These Four Key Student Loan Deadlines Matter

Federal student loan borrowers have faced years of shifting policies—from pandemic pauses to sweeping forgiveness proposals. But 2026 will mark a hard reset on some of the most generous terms we’ve seen in recent memory.

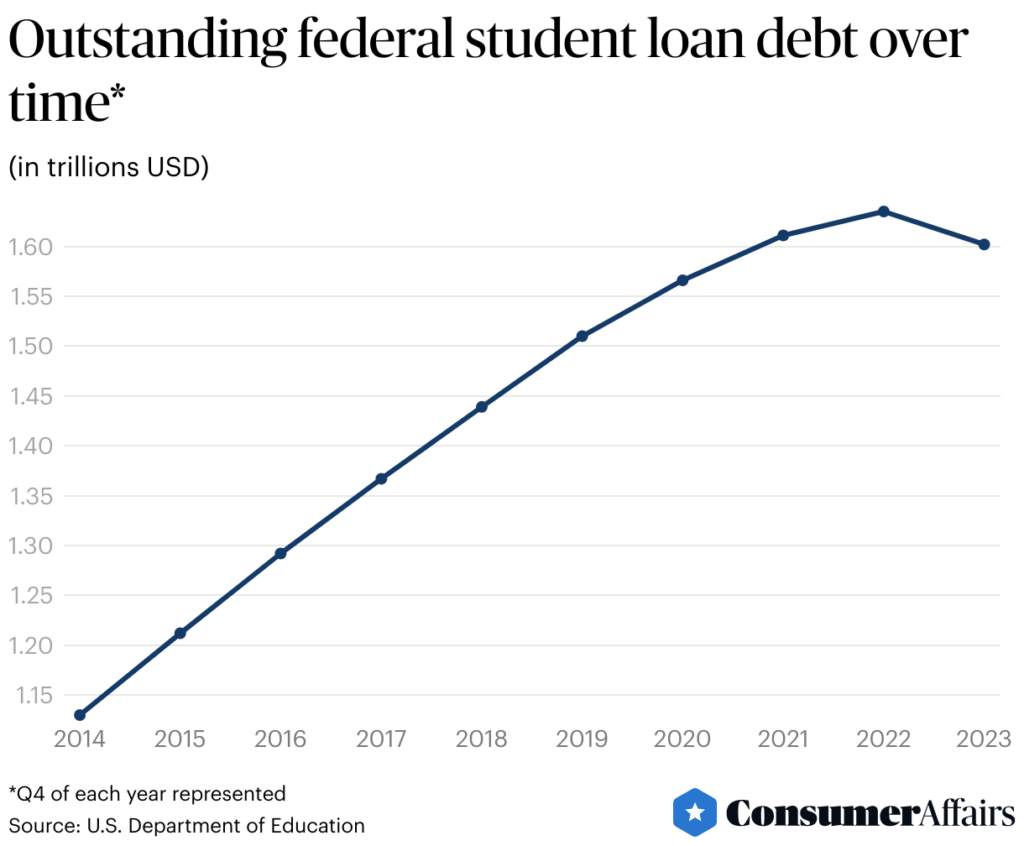

According to the U.S. Department of Education, more than 43 million Americans hold federal student loan debt, totaling over $1.6 trillion. And while temporary programs like the IDR Account Adjustment and PSLF Waiver offered relief, the windows for taking advantage of these are closing fast.

Failing to meet the 2026 deadlines could mean:

- Being locked out of income-driven repayment (IDR) plans

- Losing eligibility for Public Service Loan Forgiveness (PSLF)

- Facing longer or more expensive repayment plans

- Missing out on debt cancellation opportunities

Let’s dive into each deadline and what you should do.

1. June 30, 2026 – Consolidate Your Loans to Stay Eligible

Borrowers with older federal loans—like FFEL (Federal Family Education Loans), Perkins Loans, and Parent PLUS Loans—need to consolidate into a Direct Consolidation Loan by June 30, 2026.

Why It Matters?

Only Direct Loans are eligible for many modern repayment and forgiveness programs, including:

- SAVE Plan (newest and most affordable IDR plan)

- Public Service Loan Forgiveness

- Future forgiveness adjustments under the IDR Account Adjustment

Real Example:

Let’s say you’re a nurse working for a non-profit hospital. You have $60,000 in FFEL loans. Even though you’re in public service, you’re not eligible for PSLF unless you consolidate those loans into a Direct Loan. Miss the deadline, and you’re out of luck.

Action Plan:

- Visit studentaid.gov/consolidation

- Use the Loan Simulator to see how consolidation would affect your payments

- Submit your application by spring 2026 to avoid processing delays

- Keep track of paperwork—processing can take 30-60 days

2. July 1, 2026 – Major Repayment Plan Overhaul

This is the cutoff date for access to existing IDR plans like:

- SAVE (formerly REPAYE)

- PAYE

- IBR

- ICR

After July 1, 2026, any new federal student loans will only be eligible for:

- The Standard 10-Year Plan, or

- A new, less generous Repayment Assistance Plan (RAP)

Why It’s a Big Deal?

The SAVE Plan allows borrowers to pay as little as $0 per month (if income is low) and receive interest subsidies that prevent balances from ballooning. New plans under the overhaul may not offer the same protections or forgiveness timelines.

Example:

If you’re planning to go to grad school in 2026–27, you should try to borrow before July 1, 2026. That way, you’ll still qualify for SAVE and possibly faster forgiveness.

Pro Tips:

- Talk to your financial aid office about accelerating your disbursements

- If you’re considering grad school, apply earlier to take out loans before the cutoff

- Save copies of Master Promissory Notes (MPNs) as proof of disbursement date

3. July 1, 2028 – Transition from Legacy Repayment Plans

This one applies to borrowers already using older IDR plans like PAYE or ICR. If you don’t switch by July 1, 2028, your servicer may automatically move you into a new repayment plan. And that could impact your forgiveness timeline and monthly payments.

What to Know:

- Some older plans have shorter forgiveness timelines (e.g., PAYE = 20 years)

- Newer plans like SAVE offer more benefits, but you could lose favorable treatment of married borrowers or interest subsidies

- Switching at the right time helps you keep PSLF credits and retain prior IDR payments

Example:

Ashley, a social worker, has been in PAYE for six years. If she transitions voluntarily to SAVE before 2028, she can keep her PSLF progress. But if her servicer moves her automatically, she might lose credit for earlier months.

4. February 10, 2026 – Borrower Defense Court Ruling

A lawsuit known as Sweet v. Cardona involves more than 200,000 borrowers who applied for borrower defense to repayment—a program designed to cancel loans for students defrauded by schools.

The court could rule that:

- All eligible borrowers automatically receive loan discharge

- Refunds are issued for payments already made

Background:

The Dept. of Education missed its January 2026 deadline to process claims, so the court could take matters into its own hands in the February 10, 2026 hearing.

What You Can Do:

- Check the status of your claim at studentaid.gov/borrower-defense

- Update your contact info in your loan servicer’s system

- Monitor court decisions at meyka.com or trusted legal blogs

Borrowers Most at Risk If They Ignore These Four Key Student Loan Deadlines

| Borrower Type | What They Risk | Recommended Action |

|---|---|---|

| Parent PLUS Borrowers | No PSLF or SAVE eligibility | Consolidate to Direct Loans |

| Graduate Students | Ineligible for SAVE if borrowing after July 1, 2026 | Borrow before cutoff |

| PSLF Applicants | Loss of PSLF credits if not in eligible plan | Switch before deadline |

| Victims of School Fraud | Miss out on full discharge/refunds | Monitor Sweet v. Cardona ruling |

Airport Security Is About to Feel Very Different — TSA’s 2026 Shift at 50 U.S. Airports

Why 2026 Is Shaping Up to Be a Turning Point for Retirement in the U.S.

What It Really Takes to Retire at 65 — State-by-State Costs Across the U.S.