The $5181 Social Security Benefit represents the highest monthly retirement payment available in 2026 under current federal law. The figure applies only to workers who meet strict earnings thresholds for at least 35 years and delay claiming benefits until age 70. While the amount reflects wage growth and annual cost-of-living adjustments, experts say only a small fraction of retirees will qualify.

According to the Social Security Administration (SSA), the maximum benefit is tied directly to lifetime taxable earnings and claiming age. For most Americans, actual monthly payments will be significantly lower.

Table of Contents

$5181 Social Security Benefit

| Key Fact | Detail |

|---|---|

| Maximum Monthly Benefit (2026) | $5,181 at age 70 |

| Estimated Taxable Wage Base (2026) | $184,500 |

| Years of Earnings Used | Highest 35 years |

| Average Retirement Benefit | About $2,000 per month |

The $5181 Social Security Benefit represents the highest retirement payment available in 2026, but qualification requires decades of high earnings and delayed claiming. Most retirees will receive substantially less. As lawmakers debate long-term reforms, workers approaching retirement face important decisions about when to claim and how Social Security fits into broader financial planning. The program remains a central pillar of American retirement security.

How the $5181 Social Security Benefit Is Calculated

The SSA calculates retirement benefits using a formula based on Average Indexed Monthly Earnings (AIME). The agency adjusts each year of a worker’s wages for inflation and averages the highest 35 earning years.

If a worker has fewer than 35 years of recorded earnings, the calculation includes zero-income years, reducing the final benefit.

The AIME feeds into a second formula that produces the Primary Insurance Amount (PIA), which determines the monthly payment at full retirement age.

Dr. Alicia Munnell, director of the Center for Retirement Research at Boston College, has written that “only a small share of workers maintain earnings at or above the taxable maximum for a full 35 years,” limiting how many retirees receive the highest benefit.

Earnings Must Reach the Taxable Maximum

Only income up to the annual Social Security wage cap counts toward benefit calculations. Earnings above that threshold are not subject to Social Security payroll taxes and do not increase retirement payments.

For 2026, the wage base is projected at approximately $184,500. Workers must earn at or above that amount for 35 years to approach the $5181 Social Security Benefit.

Why Claiming Age Matters

Claiming age significantly affects the final payment amount.

Workers may begin collecting retirement benefits at age 62. However, claiming before full retirement age results in a permanent reduction. For workers with a full retirement age of 67, early filing at 62 reduces benefits by up to 30%.

Delaying benefits increases payments through delayed retirement credits. These credits add roughly 8% per year for each year benefits are postponed past full retirement age, up to age 70.

In 2026:

- Maximum at age 62: approximately $2,969

- Maximum at age 67: approximately $4,152

- Maximum at age 70: $5181

Economist Laurence Kotlikoff of Boston University has argued that delaying benefits can substantially improve lifetime retirement income for those in good health and with sufficient savings to wait.

Historical Context: How the Maximum Benefit Has Changed

The maximum Social Security benefit has risen steadily over time, reflecting national wage growth.

In 2000, the maximum monthly benefit at full retirement age was roughly $1,911. By 2010, it had climbed to about $2,346. The projected $5181 Social Security Benefit in 2026 illustrates how indexing formulas have significantly increased payments for top earners.

However, while the maximum benefit has grown, income inequality has widened. According to research from the Urban Institute, fewer than 6% of workers consistently earn above the taxable maximum during their careers.

Cost-of-Living Adjustments and Inflation

Annual cost-of-living adjustments (COLA) help preserve purchasing power. These increases are tied to changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

Following elevated inflation in 2022 and 2023, COLA adjustments reached multi-decade highs. More recently, increases have moderated as inflation slowed.

The SSA adjusts benefits each January. For retirees receiving the maximum payment, even small percentage increases translate into substantial dollar gains.

Taxation of the $5181 Social Security Benefit

While the maximum benefit appears substantial, federal taxes may reduce the net amount.

According to the Internal Revenue Service (IRS), up to 85% of Social Security benefits may be taxable depending on total income. High-income retirees receiving the $5181 Social Security Benefit are likely to pay federal income tax on most of that amount.

Some states also tax Social Security benefits, though many have phased out such taxation in recent years.

Medicare Premium Deductions

Most retirees enrolled in Medicare Part B have premiums automatically deducted from their Social Security payments.

Higher-income beneficiaries may pay Income-Related Monthly Adjustment Amounts (IRMAA), which increase Medicare premiums. For high earners receiving the $5181 Social Security Benefit, these deductions can meaningfully reduce the net monthly deposit.

Spousal and Survivor Benefits

Spouses may receive benefits based on their partner’s earnings record. A spouse can receive up to 50% of the worker’s full retirement benefit, depending on claiming age.

Survivor benefits can equal up to 100% of the deceased worker’s benefit if claimed at full retirement age.

For households with one high earner who qualifies for the $5181 Social Security Benefit, spousal and survivor planning plays a significant role in overall retirement income security.

Who Actually Qualifies?

SSA data shows that:

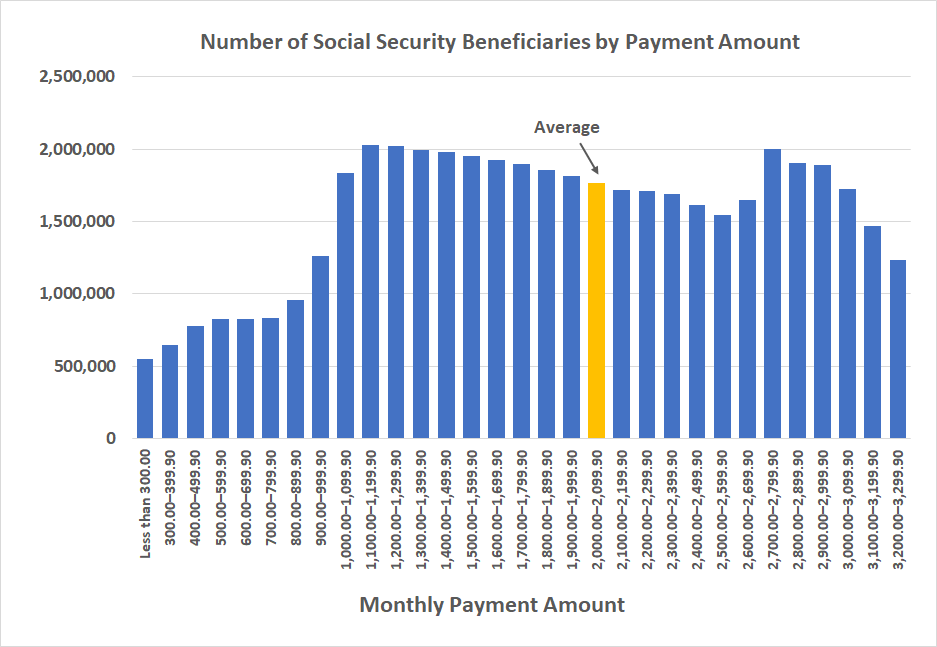

- The average monthly retirement benefit is roughly $2,000.

- Only a small percentage of workers earn at or above the taxable maximum for 35 years.

- Many retirees claim benefits before age 70 due to health concerns or job loss.

The program’s benefit formula is progressive, meaning lower-income workers receive a higher percentage of their pre-retirement income than high earners.

As a result, the $5181 Social Security Benefit is concentrated among professionals, executives, and business owners with long, high-earning careers.

Geographic and Demographic Trends

High earners are more likely to reside in metropolitan regions with strong professional sectors, including finance, technology, healthcare, and law.

Workers in states such as California, New York, Texas, and Massachusetts are statistically more likely to reach the taxable maximum due to higher wage levels.

Gender disparities also persist. According to SSA data, women historically have lower lifetime earnings due to wage gaps and workforce interruptions, making qualification for the maximum benefit less common among female retirees.

Policy Outlook and Long-Term Solvency

The future of maximum benefits depends on Social Security’s financial outlook.

The latest Trustees Report projects that the program’s trust fund reserves could be depleted in the early 2030s without legislative changes. At that point, payroll tax revenue would cover approximately 75% to 80% of scheduled benefits.

Lawmakers have proposed:

- Raising or eliminating the taxable wage cap

- Adjusting the benefit formula

- Increasing payroll tax rates

- Raising the retirement age

No major reforms have been enacted as of early 2026.

Policy experts caution that while the $5181 Social Security Benefit remains legally payable under current law, long-term structural changes could affect future retirees.

Practical Steps for Workers

Financial planners recommend:

- Reviewing earnings records annually through a “my Social Security” account

- Correcting reporting errors promptly

- Considering life expectancy and family longevity

- Coordinating claiming decisions with pensions and retirement savings

- Evaluating tax implications before filing

Experts emphasize that maximizing benefits is not automatically the best strategy for every retiree. The optimal approach depends on personal health, marital status, employment outlook, and total assets.

FAQ

Is the $5181 Social Security Benefit guaranteed?

It reflects the maximum benefit under current law for 2026. Future changes depend on wage growth and potential legislation.

Can earnings above the wage cap increase benefits?

No. Income above the annual taxable maximum does not affect benefit calculations.

Does delaying past age 70 increase payments?

No. Delayed retirement credits stop at age 70.

Can self-employed workers qualify?

Yes. Self-employed individuals who pay Social Security payroll taxes and meet the earnings requirements may qualify.