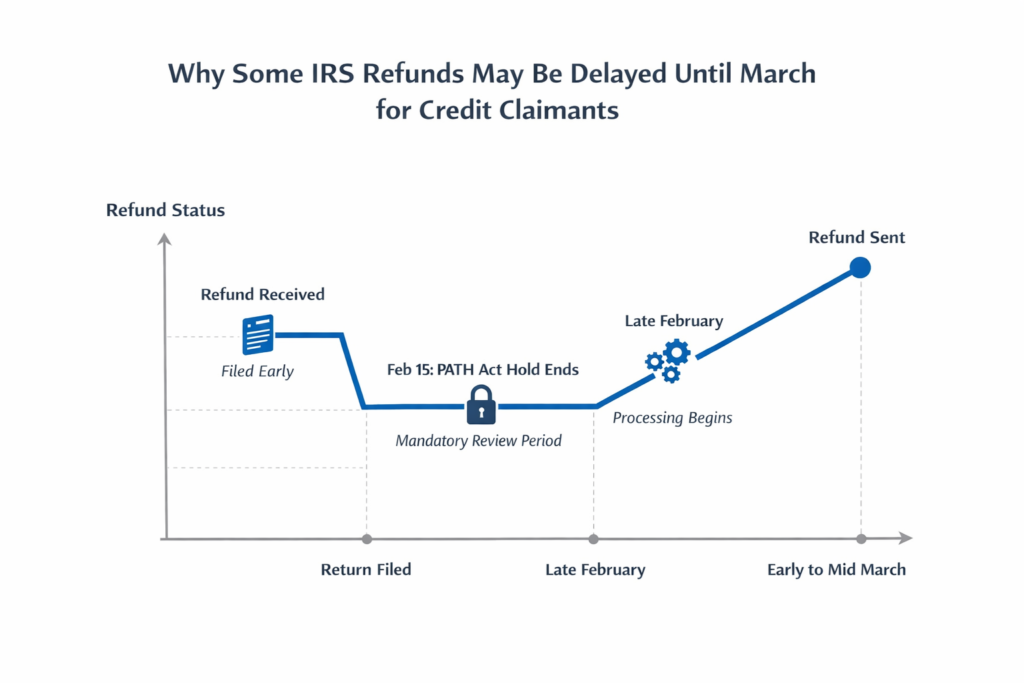

Tax season can be stressful, especially when you’re counting on a refund to cover important expenses. Every year, many taxpayers ask the same question: why is my refund taking so long? One of the most common explanations is Why Some IRS Refunds May Be Delayed Until March for Credit Claimants.

This issue affects millions of filers, particularly families and individuals who qualify for certain refundable tax credits. Understanding Why Some IRS Refunds May Be Delayed Until March for Credit Claimants can help you set realistic expectations and avoid unnecessary worry. Refund delays don’t automatically mean something went wrong with your tax return. In most cases, the delay is part of a built-in process designed to protect taxpayers and prevent fraud. Once you understand how and why these delays happen, the waiting period becomes far less confusing.

To truly understand Why Some IRS Refunds May Be Delayed Until March for Credit Claimants, you need to look at how refundable credits work. Refundable credits can increase your refund even if you owe little or no tax. Because these credits involve large payouts, they are closely monitored. Tax authorities are legally required to verify income details, employment records, and dependent information before releasing refunds that include certain credits. These checks take time and apply to everyone who claims those credits, regardless of how early they file or how accurate their return may be.

Table of Contents

IRS Refunds May Be Delayed Until March for Credit Claimants

| Category | Details |

|---|---|

| Affected Taxpayers | Filers claiming refundable credits |

| Main Cause of Delay | Mandatory income and identity verification |

| Typical Refund Timeline | Late February to March |

| Fastest Filing Method | Electronic filing with direct deposit |

| Refund Tracking | Official refund status tools |

| Action Needed | Usually none unless contacted |

Waiting for a tax refund can be frustrating, especially when you’re not sure why it’s taking so long. Why Some IRS Refunds May Be Delayed Until March for Credit Claimants is largely about legal safeguards and fraud prevention, not mistakes or penalties. By knowing which credits trigger delays, understanding the timeline, and filing accurately, you can navigate tax season with greater confidence. While the wait isn’t ideal, these rules exist to protect taxpayers and ensure refunds go to the people who truly qualify for them.

Credits That Commonly Trigger Refund Delays

One of the main reasons Why Some IRS Refunds May Be Delayed Until March for Credit Claimants is the specific credits included on the tax return. These credits are valuable but require extra review.

Earned Income Tax Credit

The Earned Income Tax Credit is designed to support working individuals and families with low to moderate income. Depending on household size and income, this credit can significantly boost a refund. Because it is often targeted by fraudulent claims, refunds that include this credit are automatically held for additional checks.

Additional Child Tax Credit

The Additional Child Tax Credit applies when a taxpayer qualifies for the Child Tax Credit but cannot claim the full amount as a nonrefundable credit. The refundable portion is subject to the same delay rules as other high-risk credits, contributing to Why Some IRS Refunds May Be Delayed Until March for Credit Claimants.

The Legal Reason Behind The Delay

- The biggest factor behind Why Some IRS Refunds May Be Delayed Until March for Credit Claimants is federal law. Legislation passed to reduce tax fraud requires refunds tied to certain credits to be held until mid-February at the earliest.

- This waiting period allows tax authorities to compare tax return data with employer wage reports and other records. Without this step, fraudulent refunds could be issued before discrepancies are detected. While this can be frustrating for honest taxpayers, the rule has helped significantly reduce identity theft and false claims.

When Refunds Are Typically Released

- Many taxpayers assume refunds will arrive immediately after the legal hold ends. In reality, processing still takes time, which further explains Why Some IRS Refunds May Be Delayed Until March for Credit Claimants.

- Once the hold lifts, returns are processed in stages. Some refunds arrive in late February, while others show up in early or mid-March. The exact timing depends on processing volume, bank procedures, and whether there are any minor issues with the return.

- Weekends and holidays can also slow down deposits, even after a refund has been approved.

How Filing Method Affects Timing

Although filing method does not remove the legal delay, it still affects how quickly you receive your money once processing begins. Electronic filing with direct deposit is consistently the fastest option. Paper returns take longer to process and are more likely to experience delays due to manual handling. Small errors, missing forms, or mismatched information can also slow things down. Filing accurately and electronically helps minimize extra waiting time, even when credits are involved.

How To Track Your IRS Refund Status

If you’re concerned about Why Some IRS Refunds May Be Delayed Until March for Credit Claimants, tracking tools can offer peace of mind. Refund status systems typically update once per day and show whether your return has been received, approved, or sent. It’s normal for returns with refundable credits to remain in the “received” stage for several weeks. This does not mean there is a problem. Contacting tax authorities during this period usually won’t speed things up unless additional information is required.

Common Mistakes That Can Cause Extra Delays

While most delays are standard, certain mistakes can extend the wait even further. Incorrect Social Security numbers, mismatched income amounts, or missing forms are common issues. Banking errors, such as entering the wrong account number, can also delay refunds. Double-checking your return before filing reduces the risk of avoidable setbacks and helps ensure your refund arrives as soon as possible.

What To Do If Your Refund Is Still Delayed After March

For most taxpayers, refunds arrive by mid-March. If yours hasn’t, reviewing your return is the first step. Look for errors, missing documents, or incorrect bank details. If more information is needed, you will usually receive a notice by mail explaining what to do next. Responding promptly can help resolve the issue. In some cases, refunds may be reduced or offset due to unpaid debts, which will also be explained in official correspondence.

Planning Ahead For Future Tax Seasons

Once you understand Why Some IRS Refunds May Be Delayed Until March for Credit Claimants, planning becomes much easier. If you rely heavily on your refund, consider adjusting your withholding to avoid overpaying throughout the year. Building a small emergency fund, even gradually, can reduce the financial pressure of waiting for a refund. Filing early, keeping records organized, and using reliable tax preparation tools or professionals can also make future tax seasons smoother.

FAQs on IRS Refunds May Be Delayed Until March for Credit Claimants

1. Why are refunds with credits delayed every year?

Refundable credits require extra verification to prevent fraud, which leads to mandatory delays.

2. Does filing early avoid the March delay?

No, filing early does not bypass the required holding period for certain credits.

3. Will direct deposit make my refund arrive sooner?

Direct deposit helps once processing starts, but it does not remove the legal delay.

4. Is a delayed refund a sign of an audit?

In most cases, no. Delays are normal for returns claiming refundable credits.