Rent has quietly become one of the largest financial pressures for modern households. In many cities, tenants now spend 30% to 50% of their income just to keep a roof over their heads. Yet most renters still believe tax benefits are only for homeowners.

That’s not entirely true. Renters tax relief exists to reduce the burden of housing costs, and renters tax relief can significantly lower what you owe at tax time or even put money back into your bank account. surprising number of taxpayers never check whether they qualify. They file their taxes, accept the result, and move on often leaving hundreds or even thousands unclaimed. The rules aren’t complicated, but they do require awareness and a little preparation. If you pay rent and submit a tax return each year, you owe it to yourself to understand how this benefit works.

Renters tax relief is designed to create fairness in the tax system. Homeowners typically receive deductions related to mortgage interest and property taxes, while tenants traditionally received nothing. To correct that imbalance, tax authorities introduced renters tax relief programs that allow eligible tenants to claim a credit or deduction based on rent payments. The benefit usually applies only to your main residence, and the amount depends on income level and annual rent paid. The lower your income and the higher your housing costs relative to earnings, the greater the potential benefit. Many people discover they qualify only after reviewing filing instructions carefully. Unlike some automatic tax adjustments, renters tax relief must usually be claimed actively during filing.

Table of Contents

Some Renters Could Claim Thousands in Tax Relief

| Key Factor | Details |

|---|---|

| Who Can Qualify | Individuals paying rent for primary residence |

| Income Requirement | Low- to middle-income thresholds generally apply |

| Proof Needed | Lease agreement, receipts, landlord details |

| Potential Benefit | Hundreds to several thousand in refunds |

| Filing Method | Claimed during annual tax return |

| Common Mistake | Missing rent documentation |

| Covered Property | Primary residential property only |

| Claim Frequency | Once per tax year |

Renters face rising housing expenses, and tax systems have adapted to help offset that burden. The benefit isn’t complicated, but it does require attention and documentation. When claimed correctly, renters tax relief can return meaningful money to your yearly budget. Before filing your next tax return, review your rent payments carefully. Check your receipts, confirm your eligibility, and complete the appropriate section of your filing. A little preparation can produce a surprisingly large reward. Too many taxpayers discover years later they could have been receiving refunds all along. Don’t let that happen to you. Understanding the rules and keeping records may be one of the easiest financial decisions you make this year.

Who Is Eligible to Claim Thousands in Tax Relief

- Eligibility depends on a few important conditions. First, the rented property must be your primary residence. If you stay somewhere temporarily such as a vacation rental or short-term company housing the claim will almost always be denied.

- Second, income matters. Renters tax relief is typically intended for low- and middle-income earners. If your earnings exceed the defined threshold, the benefit may shrink or disappear entirely. This rule exists so assistance goes to households most affected by housing affordability.

- Another key rule is that you cannot claim homeowner housing deductions and renters tax relief for the same period. If you bought a house midway through the year, you may only claim the benefit for the months you were actually renting.

- Students, young professionals, retirees, and even part-time workers can qualify as long as they paid rent and filed taxes independently.

How Much You Could Receive

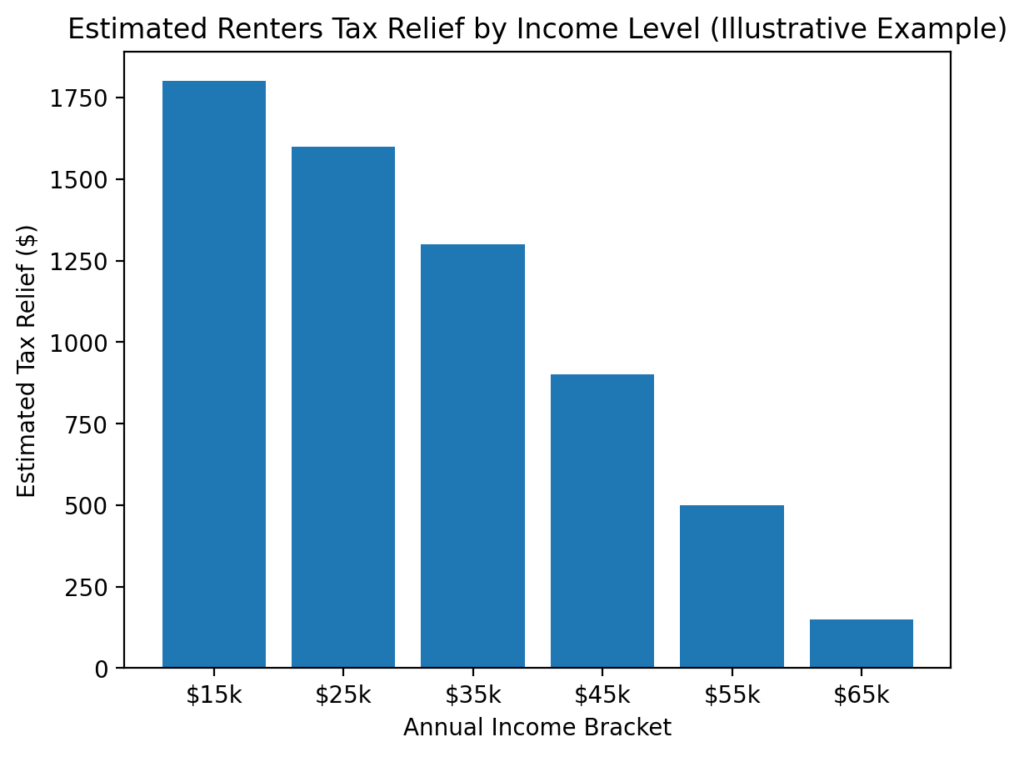

The amount varies widely and often surprises first-time claimants. The credit or deduction is calculated using rent paid and income earned. In simple terms, the system looks at how heavy your rent burden is relative to your earnings.

Factors influencing the amount include:

- Total rent paid annually

- Income bracket

- Family size

- Filing status

- Regional housing credit formulas

Someone paying high rent on a modest income often qualifies for the largest refund. In certain cases, renters tax relief doesn’t just reduce taxes owed it actually produces a refund payment. For example, if you owed a small amount in taxes but qualified for a larger credit, the tax authority sends you the difference. Many tenants are shocked to learn their refund can equal a month’s rent.

Documents You Must Keep

Documentation is the most critical part of the process. Most rejected claims happen not because the taxpayer was ineligible, but because proof was missing.

You should keep:

- Signed lease agreement

- Monthly rent receipts

- Bank transfer or digital payment confirmation

- Landlord’s full name and address

- Utility bill showing your occupancy

Paying cash without a receipt is risky. If you cannot show evidence of payment, the tax authority has no way to verify the claim. Even a legitimate renter can lose the benefit due to missing paperwork. The smartest habit is simple: save proof every month. A small folder on your phone or computer can protect a refund worth hundred.

How To Claim Thousands in Tax Relief

Claiming renters tax relief is usually part of the annual tax filing process. You don’t need a separate application in most cases. Instead, you fill out the housing or rent credit section on your return.

Here’s a practical approach:

- First, calculate total rent paid during the year.

- Second, enter your landlord’s details accurately.

- Third, attach or upload supporting documents if required.

- Fourth, verify eligibility thresholds.

- Finally, submit your return before the deadline.

Many people prefer using a tax preparer the first time they claim it. After one year, the process becomes familiar and easy to repeat.

Deadlines Matter

- Deadlines play a bigger role than people expect. Renters tax relief is typically processed along with your yearly tax return. Missing the filing date can delay your refund or require an amended filing.

- Late filing doesn’t always cancel eligibility, but it complicates the process. Additional verification may be required, and refunds can take months longer.

- A simple solution is to start preparing a few weeks before the due date. Gathering receipts early avoids stress and reduces mistakes.

Common Reasons Claims Get Rejected

Most rejections are preventable. The usual causes include:

- Incomplete landlord information

- No payment proof

- Claiming a non-primary residence

- Income exceeding the eligibility limit

- Mathematical or entry errors on forms

Even small mistakes a wrong address number or misspelled landlord name can trigger review or denial. Reviewing your return carefully before submission dramatically increases approval chances.

Tips To Maximize Your Refund

- Small habits can make a big financial difference.

- Pay rent digitally when possible so you automatically create records.

- Always request a receipt if paying cash.

- Keep documents organized throughout the year instead of scrambling at tax time.

- Review your eligibility annually because income changes can affect qualification.

- File early. Early filers often receive refunds faster and avoid last-minute problems.

- Many people who never qualified in the past become eligible later due to salary changes, relocation, or family adjustments.

Why Many Renters Never Claim

- Lack of awareness is the main reason. People often assume tax benefits apply only to property owners. Others believe the refund will be too small to matter.

- But housing costs have increased dramatically in recent years, making renters tax relief more valuable than before. For lower-income households, the refund can cover utility bills, debt payments, or emergency savings.

- In reality, many renters skip the claim simply because no one mentioned it. Tax forms can be intimidating, and if a person isn’t told to look for the benefit, they rarely discover it alone.

FAQs on Some Renters Could Claim Thousands in Tax Relief

1. Who qualifies for renters tax relief?

Anyone who pays rent for a primary residence and meets income limits may qualify, provided proper documentation is available.

2. Can students apply for the benefit?

Yes. Students living independently and filing their own taxes can often claim it.

3. Is a lease agreement required?

It is strongly recommended. If unavailable, consistent payment records and landlord information may still work but approval becomes harder.

4. What if I paid rent in cash?

You must obtain signed receipts from the landlord. Without proof, the claim can be denied.