Rent keeps climbing almost everywhere, and for many households it now eats up the largest share of monthly income. What most tenants don’t realize is that State Tax Relief for Renters exists in several states, and it can return real money to your bank account.

The surprising part is how many eligible people never apply. This State Tax Relief for Renters program is specifically meant for residents who indirectly pay property taxes through rent but don’t receive the same tax advantages homeowners do. If you rented your primary home last year, you could qualify for a sizable refund. Depending on income, rent amount, and household size, the payment can reach as high as $2,720. With housing prices and utility costs still high in 2026, this refund can genuinely help cover day-to-day expenses rather than feeling like a minor tax adjustment.

The State Tax Relief for Renters program works differently from a federal tax credit. It is usually administered by individual state tax departments and requires a separate application. Instead of a deduction that reduces taxable income, this program provides an actual refund payment. A percentage of your annual rent is treated as property tax paid indirectly, and the state returns part of it to you. Seniors, working families, and moderate-income earners often qualify, but the exact amount depends on income and rent paid. Once paperwork is submitted correctly, payments are typically issued later in the year.

Table of Contents

Up to $2,720 in State Tax Relief

| Key Detail | Information |

|---|---|

| Maximum Benefit | Up to $2,720 |

| Type Of Benefit | Refund or property tax credit |

| Who Can Apply | Renters within income limits |

| Required Proof | Rent certificate or landlord statement |

| Income Factor | Sliding scale based on earnings |

| Filing | Separate form from income tax return |

| Payment Time | Late summer or fall |

| Purpose | Offset property taxes included in rent |

The biggest barrier to State Tax Relief for Renters is awareness. Every year, a large number of renters qualify but never apply simply because they do not know the program exists. The application itself usually takes less than an hour once documents are ready. If you rented last year, checking eligibility is worth your time. A refund of up to $2,720 is not a minor benefit. It can provide real financial breathing room, especially during periods of higher living expenses. Even if you think your income might be too high, it is still worth reviewing the requirements. Many people are surprised to discover they qualify.

Who Is Eligible For Payment Up to $2,720 in State Tax Relief

Eligibility rules differ slightly from state to state, but the core requirements remain very similar across programs offering State Tax Relief for Renters.

You may qualify if:

- You rented a home, apartment, or qualifying housing unit

- The property was your primary residence

- You paid rent during the tax year

- Your landlord paid property tax on the building

- Your income falls within the allowed limits

Temporary arrangements such as hotels, short-term stays, or vacation rentals generally do not count. However, standard apartments, rented houses, senior living apartments, and some manufactured homes do qualify. Students living off campus often assume they are ineligible. In many cases they can qualify, especially if they earn limited income and pay rent directly rather than through a dormitory housing contract.

Income Limits and Household Size

Income is one of the most important factors in calculating State Tax Relief For Renters benefits. The program is designed primarily for low- and moderate-income households, though the definition of moderate income can be higher than many people expect.

Here is how eligibility usually works:

- Single individuals have lower income thresholds

- Married couples qualify at higher limits

- Families with children receive expanded allowances

- Seniors often qualify at even higher income levels

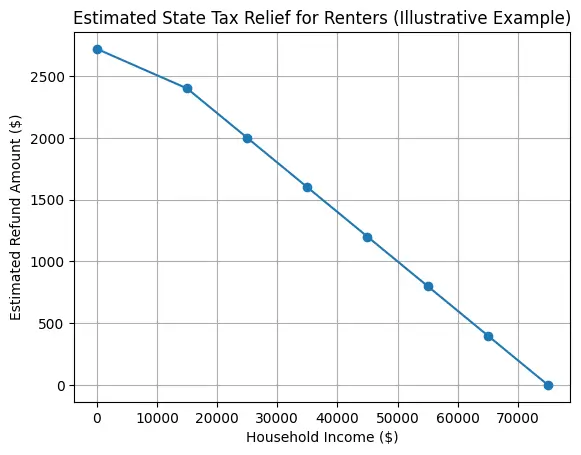

The refund operates on a sliding scale. Lower-income households receive the largest payments, while higher earners receive smaller refunds or none at all. Even so, many working households who assume they earn too much actually still qualify.

How The Credit Is Calculated

Many renters believe they never pay property taxes. In reality, they do. Landlords build property tax costs into rent prices. The State Tax Relief for Renters program acknowledges this and estimates the tax portion within your rent.

States generally follow a three-step formula:

- A fixed percentage of total annual rent is treated as property tax.

- That figure is compared to household income.

- A refund is calculated using a benefit formula.

For example, a renter with relatively low income and higher rent payments typically receives a larger refund. Meanwhile, a renter with higher income and lower rent receives less. This explains why two tenants living in identical apartments may receive very different refund amounts.

Documents You’ll Need

Before applying for State Tax Relief for Renters, gathering documents will save time and prevent delays. Missing paperwork is the most common reason claims get rejected or delayed.

You will generally need:

- Rent paid certificate or landlord statement

- Income documentation such as W-2 or benefit statements

- Identification number (Social Security or tax ID)

- Banking information for direct deposit

The rent certificate is especially important. It verifies the total rent paid during the year and confirms the property is taxable housing. Request it from your landlord early because many landlords receive multiple requests close to filing deadlines.

How To Apply For Up to $2,720 in State Tax Relief

Applying for State Tax Relief for Renters is simpler than most people expect, but it is separate from your standard tax filing. Even if you filed your income taxes already, you still need to complete this application.

Basic steps:

- Request a rent certificate from your landlord

- Download or access the renter refund form

- Enter household and income details

- Attach supporting documentation

- Submit the form online or by mail

Many renters miss out because tax software programs do not automatically include this application unless you specifically look for it.

Deadlines And Payment Timeline

Timing is important. Programs offering State Tax Relief for Renters usually open shortly after the regular tax season ends.

Typical timeline:

- Applications open: February or March

- Filing deadline: Mid-summer

- Processing: About 6 to 10 weeks

- Payment issued: August through October

If you file early, you usually receive payment earlier. Late filings may still be accepted, but refunds can take significantly longer.

Common Mistakes To Avoid

A large number of claims are delayed each year because of simple mistakes. Avoid these problems when applying for State Tax Relief for Renters.

Common errors include:

- Forgetting to request landlord certification

- Reporting incorrect household income

- Using a mailing address instead of residence address

- Missing the application deadline

Accuracy is extremely important. Even small errors can cause processing delays or require additional verification.

Why This Matters for Renters

Renters often feel overlooked in tax policy because homeowners receive deductions and property-tax breaks. The State Tax Relief For Renters program recognizes that tenants indirectly pay those same property taxes through rent. With rent increases continuing across many cities, this refund can make a real difference. Many households use it for:

- Utility bills

- School expenses

- Medical costs

- Emergency savings

For seniors living on fixed incomes, the refund can help them remain in their homes despite rising living costs.

FAQs on State Tax Relief

Do I Need to Own a Home to Receive This Tax Refund?

No. The program is designed specifically for tenants who rent their primary residence.

Is The Refund Considered Taxable Income?

Generally, renter refunds are not taxable, but you should verify rules for your specific state.

What If My Landlord Does Not Provide Proof of Rent?

You can contact your state tax department. Some programs allow alternate documentation or follow-up verification.

Can Seniors Receive Larger Payments?

Yes. Many programs provide expanded eligibility and higher benefits for seniors and people with disabilities.