$200 Social Security Boost: If you’ve been scrolling through social media or tuning in to local news, chances are you’ve seen claims about a $200 Social Security boost for 2026. Sounds like a game-changer, right? But before you start planning that road trip or adding extra to your grocery list, let’s break this thing down with some good ol’ fashioned facts. In this article, we’ll tackle what’s real, what’s just a rumor, and what steps you can take to plan smarter — whether you’re already retired, getting close, or helping someone else navigate retirement benefits. This is your clear, no-nonsense guide — professional enough for advisors, yet simple enough for anyone age 10 and up to understand. And yeah, we’ll toss in some personal perspective and plain talk because this is about your money, your future, and your family’s peace of mind.

Table of Contents

$200 Social Security Boost

The rumored $200 Social Security boost for 2026 is still in legislative limbo. It could happen — and it would help a lot of folks — but don’t count on it until it’s signed into law. What’s already in place is the 2.8% COLA, adding an average of $56/month to your check in 2026. That’s the number you should build your budget around. Keep tabs on Congress, advocate if you support the proposal, and use reliable resources to plan your retirement path. And remember — financial peace starts with knowing the facts.

| Feature | Details |

|---|---|

| Topic | $200 Social Security Boost for 2026 |

| Status | Proposed bill in Congress, not yet passed |

| Official 2026 COLA | 2.8% confirmed by SSA |

| Average Benefit Impact | +$56/month for most retirees |

| $200 Monthly Boost | Part of a temporary 6-month relief proposal |

| Applies To | Social Security retirees, SSDI, SSI, veterans, and railroad retirees |

| Reliable Sources | ssa.gov, congress.gov |

What’s the Real Story Behind the $200 Social Security Boost?

Let’s not beat around the bush — the $200 Social Security increase is not a guaranteed benefit for 2026. It’s part of a proposed law, specifically a version of the Social Security Expansion Act that’s been floating around Congress.

The idea is simple: give every Social Security recipient an extra $200 a month to help combat inflation, rising housing costs, and increasing healthcare premiums. Sounds good on paper. But here’s the catch:

- It hasn’t been passed.

- It’s not included in the 2026 budget — yet.

- It would be a temporary increase (six months only).

So if you’re banking on that money already, you might want to hold your horses.

What’s Actually Confirmed for 2026?

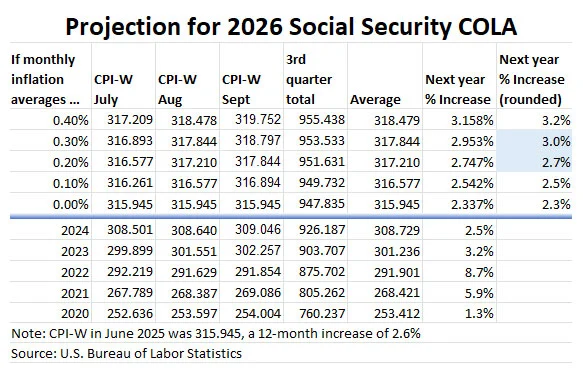

The real, confirmed, and already locked-in increase is the Cost-of-Living Adjustment (COLA) — and for 2026, that’s a 2.8% bump, announced by the Social Security Administration in October 2025.

What does a 2.8% COLA mean?

If you’re receiving the average retirement benefit of around $1,848/month, that 2.8% gives you about $56 extra every month.

Here’s the math:

- $1,848 × 0.028 = $51.74

- New total = ~$1,900/month

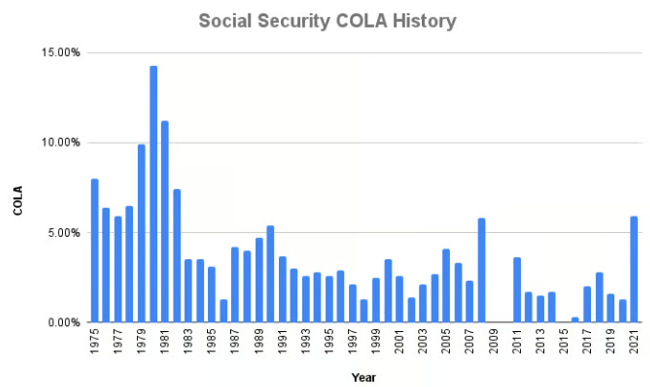

Even if that doesn’t sound like a windfall, it still beats no raise at all — especially since COLA is built into the system and legally required to reflect inflation (based on the Consumer Price Index for Urban Wage Earners and Clerical Workers — CPI-W).

Where Did the $200 Social Security Boost Rumor Start?

The extra $200 stems from several proposals introduced by lawmakers over the past few years. The most notable effort is the Social Security Expansion Act, spearheaded by Senator Bernie Sanders and others.

The bill proposes:

- A $200/month raise for all Social Security recipients

- Applied temporarily from January to June 2026

- Funded through increasing payroll taxes on higher-income earners (above $250,000/year)

While the proposal sounds great, it has not cleared Congress, and it lacks bipartisan support, making it tough to become law in time for 2026 implementation.

Why Some Say COLA Isn’t Enough?

Let’s face it — inflation’s been wild the past few years. Even with COLA increases, retirees are still feeling the pinch, especially with:

- Prescription drug costs up over 8% year-over-year

- Home insurance premiums climbing 20% in some states

- Medicare Part B premiums rising nearly every year

According to a recent Kaiser Family Foundation report, the average retiree spends 15-30% of their income on healthcare alone. That’s why advocacy groups like AARP are pushing Congress to take more aggressive steps.

What Would a $200 Social Security Boost Look Like in Real Life?

Let’s say the proposal passes. Here’s a snapshot of what it might mean:

Example: Two-person retired household

- Harold (70) and Deborah (67) each receive $1,650/month

- With 2.8% COLA: +$46/month each

- Total monthly increase (confirmed): $92

If the $200/month boost is added on top?

- $200 × 2 people = $400/month extra

- For six months = $2,400 in total short-term relief

Not bad. But again — that boost is not confirmed.

What Financial Advisors & Planners Recommend?

Most financial experts agree: Plan based on COLA.

“The $200 proposal is just that — a proposal. We tell our clients to adjust budgets only when a benefit is officially approved and announced by SSA.”

— Susan Adler, CFP®, Dallas, TX

Pro Tips:

- Don’t overestimate your income. Use the SSA’s Retirement Estimator for realistic projections.

- Watch for Medicare changes. The CMS.gov site posts yearly premium updates around November.

- Meet with a financial planner annually. Update your income strategy based on confirmed changes only.

How Professionals & Working Adults Can Stay Ahead?

If you’re not on Social Security yet, here’s why this still matters:

- HR & Benefits Managers need to prep for employee questions about future benefits.

- Mid-career workers should watch how these benefit shifts affect retirement age choices.

- Young professionals should understand the program’s solvency — future changes may impact their taxes or eligibility.

Understanding how and why Social Security changes is a smart move for career planners, parents, and even college-age kids building a long-term financial strategy.

What’s the Long-Term Outlook?

Social Security is under the microscope — not just for 2026, but long-term. The trust fund that pays benefits is expected to run low by 2035, meaning Congress will eventually need to reform the program.

Possible future options include:

- Raising the retirement age

- Increasing payroll taxes

- Reducing benefits for high-income retirees

- Changing how COLA is calculated

That’s why even short-term proposals like the $200/month increase face extra scrutiny.

How the 2.8% COLA Adjustment Will Reshape Social Security Payments in 2026

Why 2026 Is Shaping Up to Be a Turning Point for Retirement in the U.S.

Social Security Payments Could Reach $5,430 a Month in 2026 — Here’s How